Power, Policy and Speed in the Next Digital Frontier

Demand for AI, cloud and digital services continues to rise, but the world’s largest data centre markets are now shaped by power scarcity, planning constraints and intensifying competition for land and grid access. DC Byte’s latest global analysis examines how hyperscalers are adapting to these pressures, where expansion is shifting and what this means for the next phase of digital infrastructure delivery.

Built on DC Byte’s proprietary intelligence and continuous tracking of more than 8,000 facilities, this report provides a clear, data-led view of the structural forces defining the global hyperscale build race.

Why This Report Matters: Strategic Insight for Operators, Suppliers and Investors

This report helps senior teams understand how power, policy and planning are reshaping the hyperscale landscape. It explains why established hubs are slowing, where redirected demand is accelerating and how delivery models are changing as AI workloads intensify.

The report includes:

- A clear view of the regions absorbing the next wave of hyperscale activity, from the US Southeast to Southern Europe and Southeast Asia.

- A stronger understanding of market readiness, including where power availability and planning reliability support faster delivery cycles.

- Evidence to support long-term strategy, showing how early leasing behaviour, self-build acceleration and sustainability expectations influence competitive positioning.

- Context for investment and development risk, helping stakeholders align capital, construction and market entry decisions with real market dynamics.

Exclusive Highlights from the Report

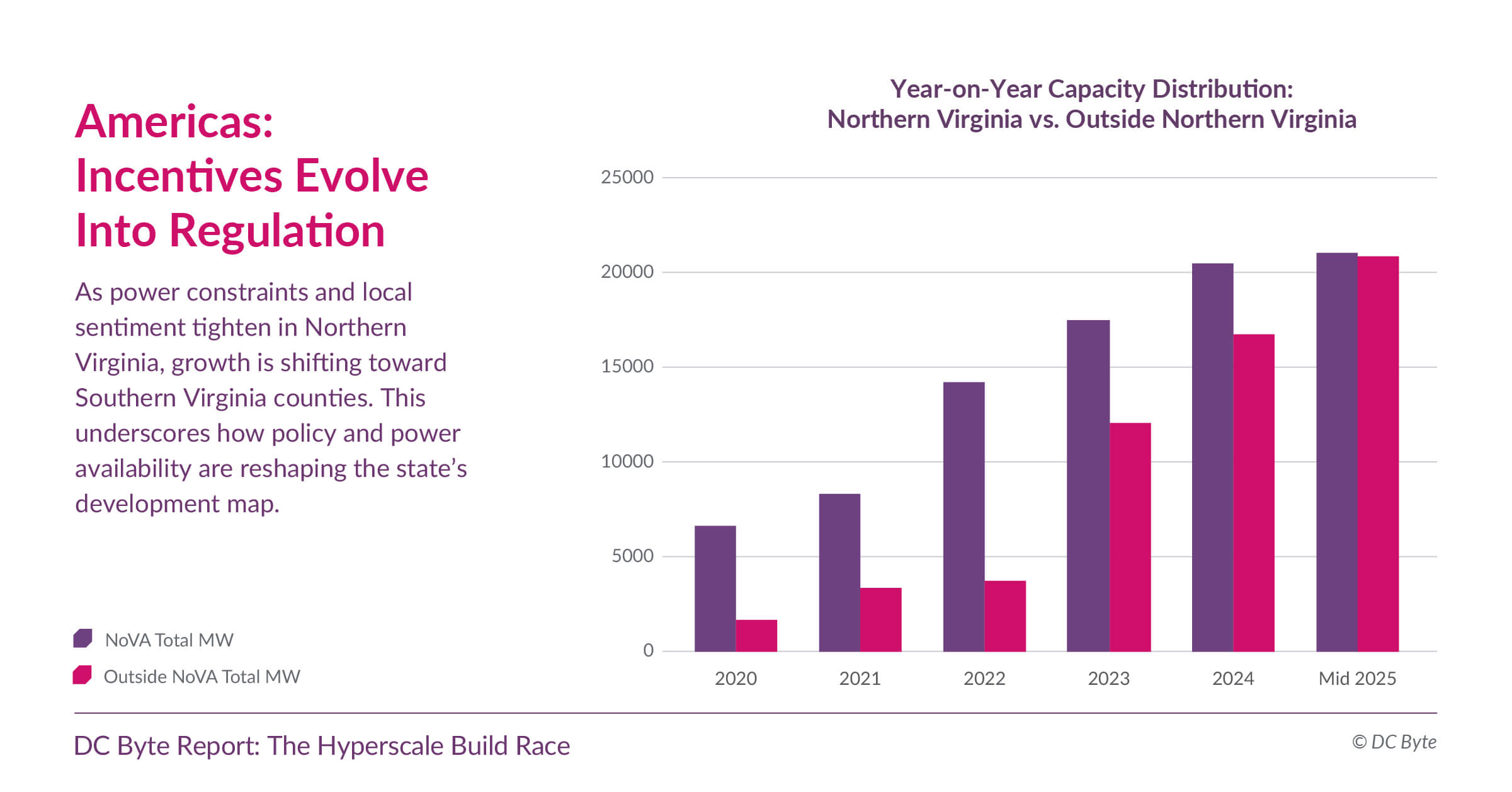

- Below 1% vacancy in key hubs. Mature metros such as Northern Virginia and Frankfurt continue to face extreme supply pressure, reinforcing early-stage power and land acquisition.

- 24 – 36 month pre-leasing cycles. Hyperscalers are committing to entire campuses well before construction begins to guarantee future capacity in constrained markets.

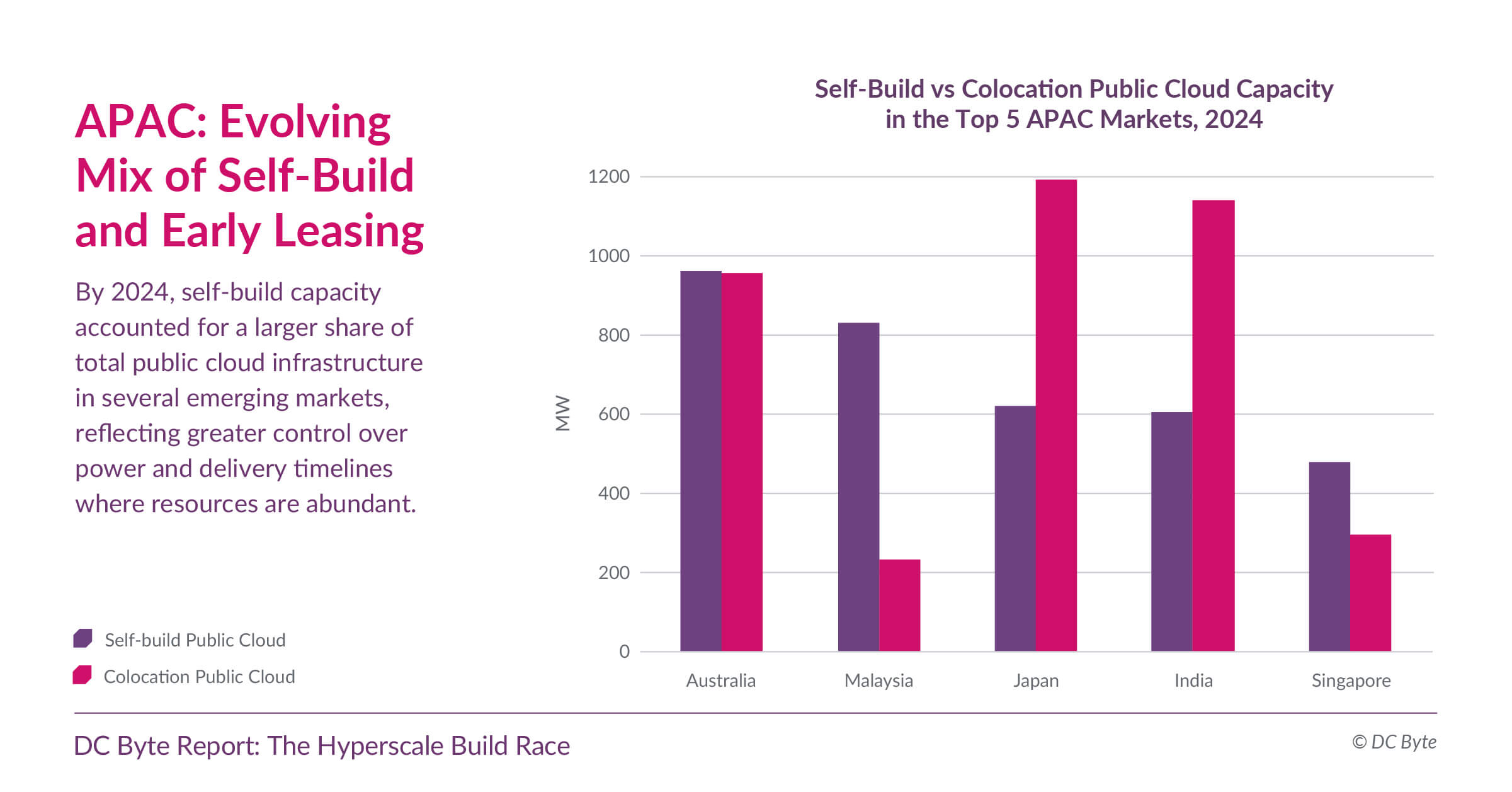

- APAC’s hyperscale capacity growth. This region grew at a five-year CAGR of 32.9%. South and Southeast Asia now anchor the region’s most rapid expansion.

- New growth corridors take shape. The US Southeast leads a new set of fast-scaling regions, with hyperscalers securing multi-site commitments across Georgia, Alabama and North Carolina.

- AI reshapes delivery models. Rising power density and longer equipment lead times are accelerating modular build strategies and supplier localisation worldwide.

This report is informed by DC Byte’s newly launched Hyperscaler Analytics capability, providing deeper visibility into hyperscaler activity, presence and long term expansion signals.

Download Your Complimentary Report Today

Whether you are an operator benchmarking market conditions, an investor evaluating long-term risk or a supplier planning ahead of hyperscaler demand, this report provides the clarity needed to act with confidence.