January 7, 2026

As the global data centre market enters 2026, the primary constraint is no longer demand. It is execution.

Hyperscale cloud and AI workloads continue to drive strong appetite for new capacity, and capital remains available across both mature and emerging markets. However, the ability to convert planned capacity into live infrastructure is becoming increasingly uncertain. Power availability, regulatory frameworks, and delivery timelines now exert greater influence over outcomes than headline pipeline size.

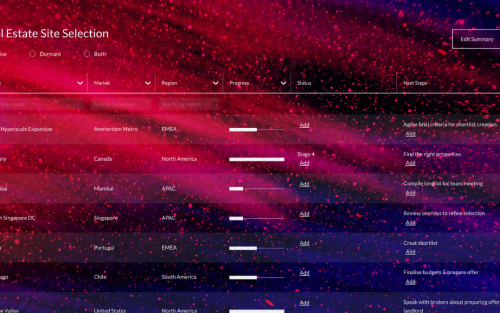

DC Byte analysis highlights five structural trends that are influencing how data centre capacity is being planned, financed, and delivered as the market moves into 2026.

Five Trends Shaping the 2026 Data Centre Landscape

- A growing share of announced and committed projects are failing to reach construction.

- Government policy is increasingly determining how fast projects move, not just whether they are approved.

- Capital is being deployed earlier in the development lifecycle, increasing exposure to delivery risk.

- Growth is shifting away from the largest and most congested data centre hubs.

- Markets with stable power supply and clear planning rules are delivering capacity more consistently.

Together, these trends point to a market where certainty has become a competitive advantage.

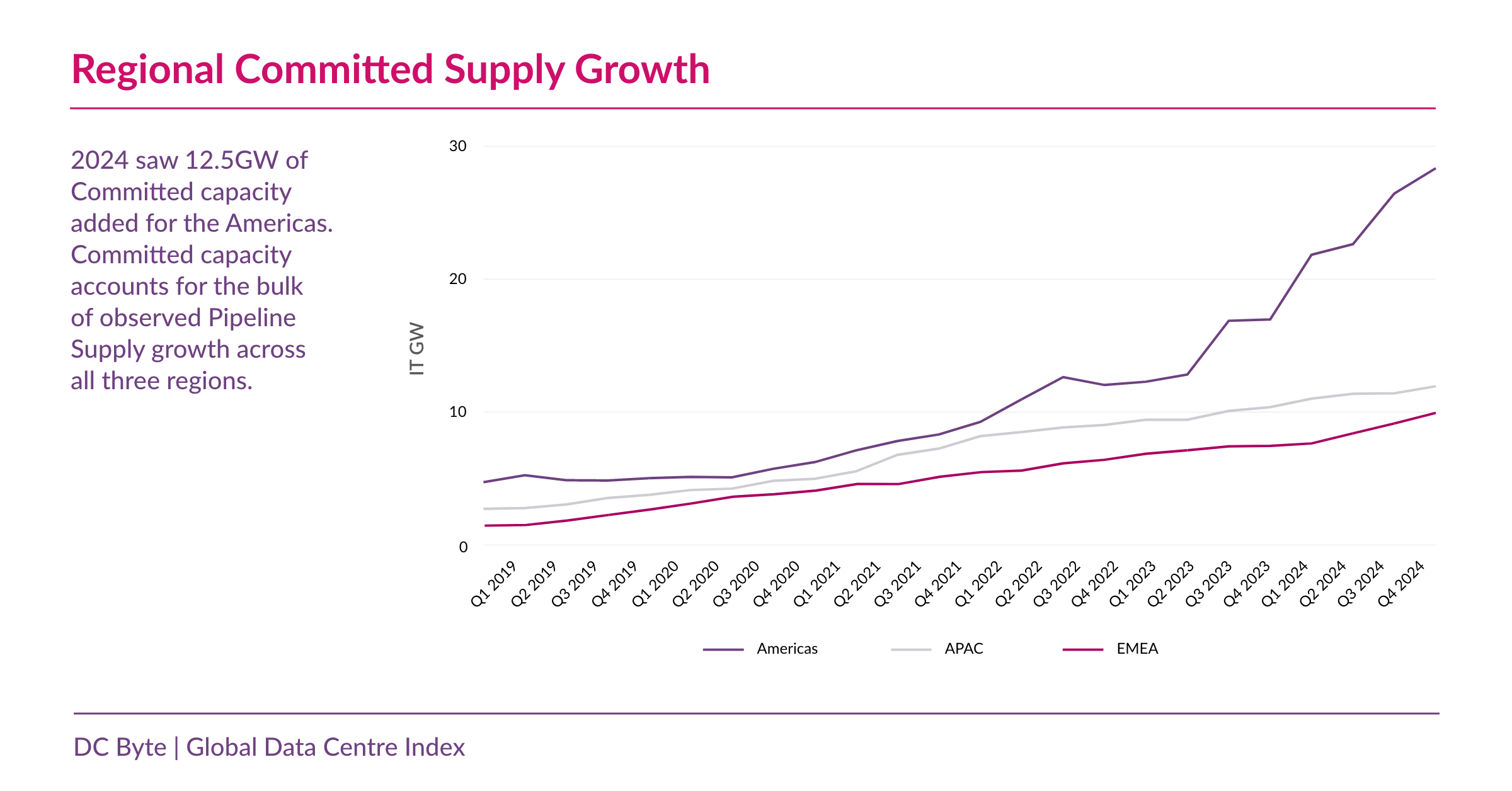

According to DC Byte’s 2025 Global Data Centre Index, committed supply has increased more than six times since 2019, while live capacity has grown at a far slower pace. This widening gap reflects a fundamental shift. Scale and demand remain intact, but execution is becoming harder, timelines less predictable, and delivery risk more material.

The analysis below draws on DC Byte’s global tracking of supply pipelines, power availability, capital deployment, and regulatory conditions. Rather than treating these trends as standalone predictions, this outlook examines what they imply for infrastructure decision-making if current constraints persist into 2026.

1. Many Data Centre Projects Are Being Announced, but Not Moving Into Construction

Across all major regions, there is a widening gap between data centre projects that are planned or committed and those that reach construction.

DC Byte data shows that global committed supply now exceeds under-construction capacity by a wide margin. In several key hubs markets, committed capacity is more than twice the volume actively being built, highlighting how much future supply remains exposed to delay.

This disconnect is not demand-driven. Public cloud, social media, and AI workloads together account for nearly 70% of global demand tracked by DC Byte. Nor is it capital-driven, as investment appetite remains strong across both core and emerging markets.

Instead, projects are increasingly stalling in the middle of the development pipeline. Power connection delays, extended permitting timelines, grid upgrade requirements, and long lead times for critical equipment are preventing many schemes from progressing beyond early-stage commitment. In mature hubs, vacancy rates have fallen below 1%, yet new capacity continues to struggle to move from plan to construction.

If these conditions persist, headline pipeline figures are likely to remain a poor proxy for near-term deliverable supply in 2026.

2. Government Rules Now Affect How Fast Projects Move, Not Just Whether They Are Allowed

Policy and regulation have become decisive factors in determining project timelines.

DC Byte research shows that in some mature markets, grid connection timelines for large-scale data centre projects are stretching deep into the late 2020s. In Northern Virginia, for example, utilities have projected that connecting projects exceeding 100 MW could take up to seven years due to grid congestion and infrastructure constraints.

Planning approvals that once took months increasingly extend into multi-year processes, even for well-capitalised developments. Environmental regulation, zoning reform, grid prioritisation frameworks, and energy efficiency mandates are all contributing to longer and less predictable delivery schedules.

At the same time, other markets are moving in the opposite direction. Governments seeking to attract digital infrastructure investment are streamlining approvals, clarifying permitting pathways, and coordinating more closely with utilities. These policy environments are converting committed projects into construction at a materially higher rate.

If current regulatory conditions remain in place, policy clarity is likely to continue influencing speed to market in 2026.

3. Investors Are Putting Money Into Projects Earlier and Taking On More Risk

Capital is moving earlier in the development lifecycle.

DC Byte analysis shows that investors are increasingly committing capital 24 to 36 months ahead of expected delivery, often at the land acquisition, power negotiation, or permitting stage. This represents a shift from historical models, where investment followed signed leases and construction milestones.

The scale of early-stage exposure is significant. Since 2019, committed supply tracked by DC Byte has increased more than six times, while operational capacity has expanded far more gradually. A growing share of capital is now tied up in future delivery rather than live infrastructure.

Early investment secures access to constrained power and land, but it also extends exposure to execution risk. Capital is now subject to regulatory change, grid delays, and supply chain constraints for longer periods.

If this pattern continues, investment performance in 2026 is likely to depend more heavily on delivery credibility than on demand forecasting alone.

4. Growth Is Moving Away From the Biggest, Most Established Data Centre Markets

As constraints intensify in the world’s largest data centre hubs, growth has been shifting toward secondary and tertiary markets.

DC Byte tracking shows that an increasing share of new hyperscale commitments has occurred outside traditional primary metros. In North America, expansion is moving beyond the most congested hubs into emerging corridors with greater grid headroom. In Europe, spillover from established FLAP-D markets is feeding growth in Southern and Central regions. In Asia-Pacific, operators are looking beyond traditional gateways as mature locations struggle to scale.

This decentralisation reflects structural limits rather than short-term opportunism. Power scarcity, land availability, and regulatory friction are reshaping long-term location strategies.

In Asia-Pacific, total hyperscale capacity grew at a 32.9% five-year CAGR between 2020 and 2025, with much of that growth occurring outside the region’s earliest hubs. If constraints in core markets persist, this shift is likely to continue influencing capacity deployment in 2026.

5. Markets With Stable Power and Clear Planning Rules Are Growing More Steadily

Not all growth patterns are equally volatile.

DC Byte’s regional analysis shows that markets with predictable power supply and coordinated planning frameworks have delivered capacity more consistently over time, with smaller gaps between announced, committed, and delivered supply.

In the Nordics, Norway’s qualified supply has grown at a 43% five-year CAGR since 2019, while Finland added more than 1,400 MW of total IT load across 2023 and 2024 alone. These markets benefit from aligned energy planning, clear permitting processes, and long-term grid investment.

While these regions may not always post the largest annual announcements, they have been more effective at converting plans into operational infrastructure. Projects progress with fewer delays, timelines are more reliable, and capital risk is lower.

If current power and policy conditions remain in place, these markets are likely to remain comparatively resilient to delivery bottlenecks in 2026.

What This Means for Data Centre Development in 2026

Taken together, these five trends point to a data centre market defined less by scale and more by certainty.

For 2026, competitive advantage is likely to be shaped by the ability to convert plans into live capacity, if current power, policy, and delivery constraints persist. Markets with predictable power, clear policy frameworks, and realistic timelines are pulling ahead, while others risk seeing ambition outpace delivery.

“As demand continues to grow, the real differentiator is no longer how much capacity is announced, but how much can actually be delivered,” said Siddharth Muzumdar, SVP of Research at DC Byte. “Power availability, planning certainty, and realistic timelines are now what separate markets that scale from those that stall.”

The next phase of global data centre growth will not be defined by headline pipeline numbers, but by execution. In an increasingly constrained environment, certainty is becoming one of the industry’s most valuable currencies.