Artificial intelligence is no longer just another workload within the data centre ecosystem.

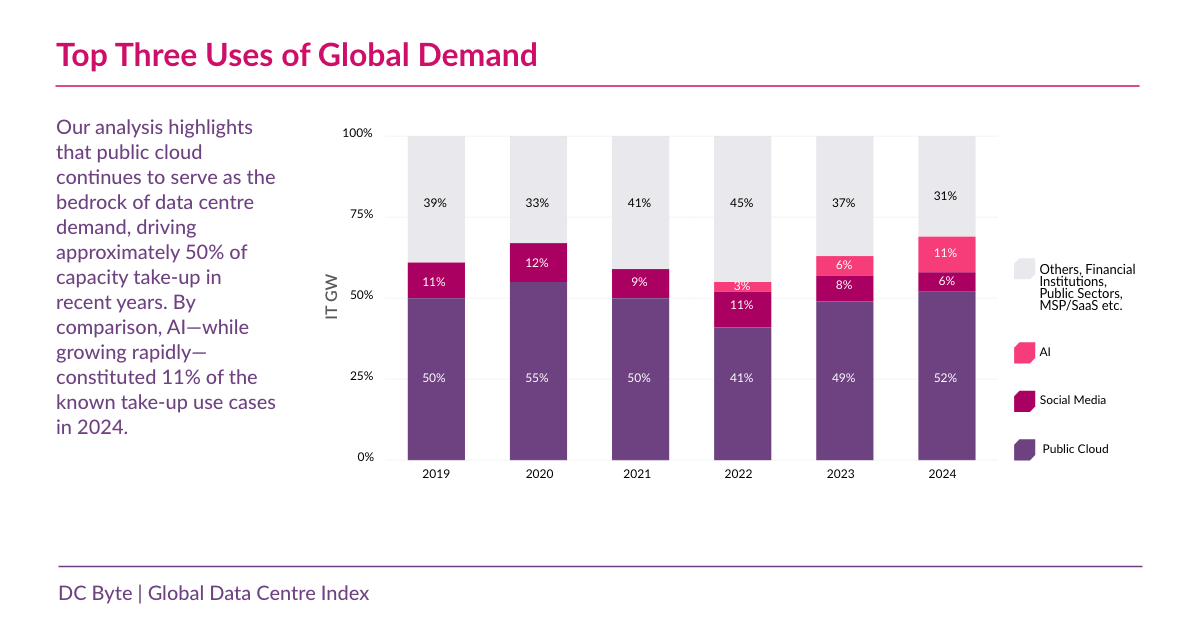

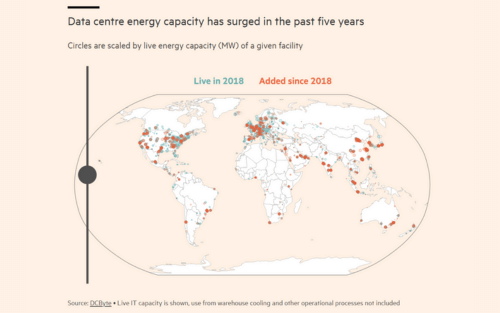

It is now one of the strongest forces reshaping how quickly capacity must be delivered. According to DC Byte’s Global Data Centre Index 2025, AI already accounts for 11% of global leased capacity as of 2024, nearly doubling from the year before.

This acceleration confirms what we outlined in our earlier piece on the AI Mandate: operators must prepare for a new generation of tenants that expect denser infrastructure and faster delivery.

“The AI boom is changing the rules for project delivery,” says Bernard Johnson, CEO of DC Byte. “Markets that can align land, power, and advanced infrastructure the fastest are the ones that will win. Suppliers who can match that speed will become indispensable partners.”

Why AI Is Changing the Build Equation

AI workloads push facilities far beyond traditional enterprise norms. Racks draw significantly higher power, thermal loads rise sharply, and interconnect needs increase because training and inference rely on high-bandwidth, low-latency links. Liquid cooling and rear-door heat exchangers are moving from optional to expected, and power distribution needs to support sustained high draw with tighter tolerances on uptime and quality.

Today’s demanding requirements mean that land, power, and network proximity are now the first things assessed, often even before the final facility designs are complete. Operators want certainty from the very beginning. They’re asking suppliers to get involved at the concept stage, providing things like reference designs, thermal models, electrical plans, preliminary lists of materials, and estimated delivery schedules. They also need solid commitments on component availability and factory production slots so they can confidently secure sites and power.

For suppliers, this changes everything. Engineering teams are now involved weeks or even months earlier. The procurement process starts sooner, and long-lead items such as transformers, switchgear, liquid cooling systems, and high-capacity cabling must be reserved before the final drawings are even set. The old linear development model has shifted to a parallel one. As a result, suppliers who can provide early design assurances and dependable delivery windows are becoming essential to winning AI projects.

Faster Timelines, Higher Stakes

In the past, power allocation, permitting, and construction often stretched over several years. AI demand is collapsing that cycle. Operators are moving land acquisition, approvals, power negotiations and supplier engagement into parallel tracks to get capacity online faster.

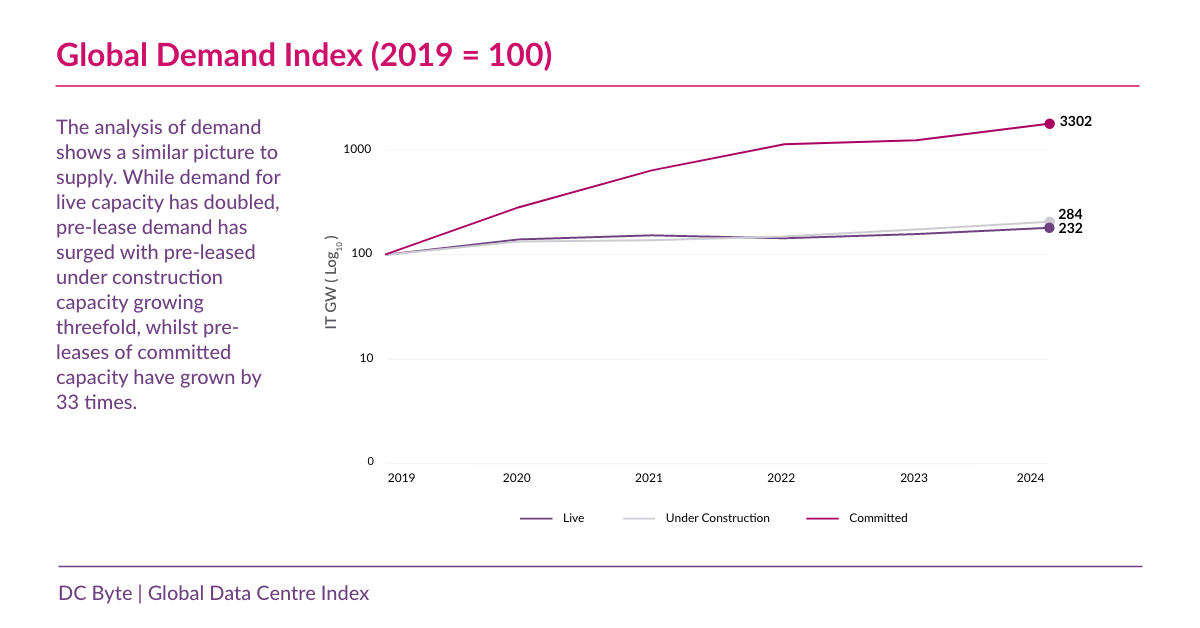

This acceleration is already visible in the data. Committed supply has increased more than sixfold since 2019, while pre-construction leasing has risen 33 times. Projects are being locked in long before ground is broken, which means suppliers are expected to deliver against commitments that move faster than traditional build schedules.

The stakes are higher as a result. A delay in transformers, switchgear, cooling systems or fibre backhaul does not just hold up one stage. It threatens the entire commissioning schedule. Operators are now choosing partners not only for technical quality but for their ability to guarantee delivery within shortened windows.

“AI-driven build clusters are not random,” says Colby Cox, Americas Managing Director at DC Byte. “They align with markets where operators can lock in energy, high-capacity connectivity and skilled labour within tight delivery windows. Suppliers that can execute reliably in these conditions are the ones who will be trusted.”

Opportunities and Risks for Suppliers

The acceleration of AI build cycles is creating both immediate opportunities and significant risks for suppliers.

Opportunities

Suppliers are being invited into projects earlier, with design input and delivery guarantees required before sites are even confirmed. Based on DC Byte data, committed supply in 2024 increased more than sixfold since 2019. Much of this capacity is tied to AI projects, where framework agreements and long-term procurement deals are now the norm. For suppliers, this means greater visibility of demand and the chance to lock in recurring business across multiple builds.

Risks

The same acceleration magnifies exposure. Compressed production windows and strained component supply chains are testing even established providers. Smaller suppliers face margin pressure as they attempt to match hyperscaler speed without scale advantages.

There is also a risk of technological mismatch: as rack densities and thermal loads rise rapidly, solutions that were sufficient just two years ago may quickly become obsolete, leaving suppliers exposed if they cannot adapt quickly. Moreover, this challenge is compounded by the difficulty of predicting future rack densities, with some AI training clusters already reaching into the hundreds of kilowatts per rack and making cooling requirements a moving target.

How to Stay Ahead in the AI Build Boom

In a market where build timelines are shrinking, early market intelligence is the decisive advantage. Knowing where AI data centre projects are in the pipeline, well before public announcements, allows suppliers, investors and operators to secure partnerships, align procurement and production with real demand, and position themselves in the fastest-growing markets for AI capacity.

The AI build boom is not a passing surge. It is redefining how quickly the industry moves from concept to live facility. For suppliers, the opportunity lies in designing earlier, securing the critical path and delivering at speed.

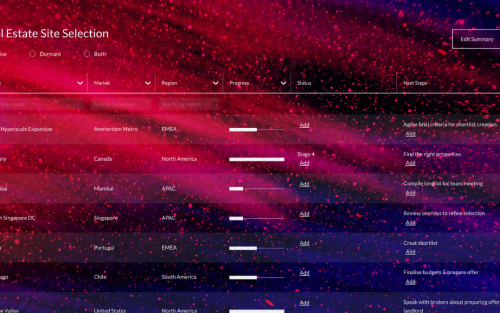

This is where DC Byte’s Supplier Analytics comes in. By tracking projects from the earliest signals such as land banking, power allocations and pre-leasing through to delivery, the platform provides the intelligence suppliers need to anticipate demand, protect margins and position themselves at the centre of the AI build boom.