Bangkok is rapidly emerging as one of Southeast Asia’s most dynamic data centre markets. With total IT capacity surpassing 2.5GW, the city now ranks as the region’s second-largest market after Johor. Strategic advantages such as abundant land, reliable power, and a central location bridging East and West are drawing a wave of international operators and hyperscalers.

The past two years have marked a step change in scale. Where Thailand was once home to smaller, retail-style facilities, the market is now seeing the development of full-scale campuses and multi-building projects. Development is also expanding beyond Bangkok’s urban core into the Eastern Economic Corridor, particularly Chonburi, which is emerging as a key strategic zone.

As our Research Analyst, Nicole Seah, puts it:

“Given the scale of development expected this year, Chonburi’s capacity is tightening rapidly. Securing large-scale power allocations for 2026 may prove increasingly challenging, making early engagement essential.”

Bangkok: A Magnet for Global Operators

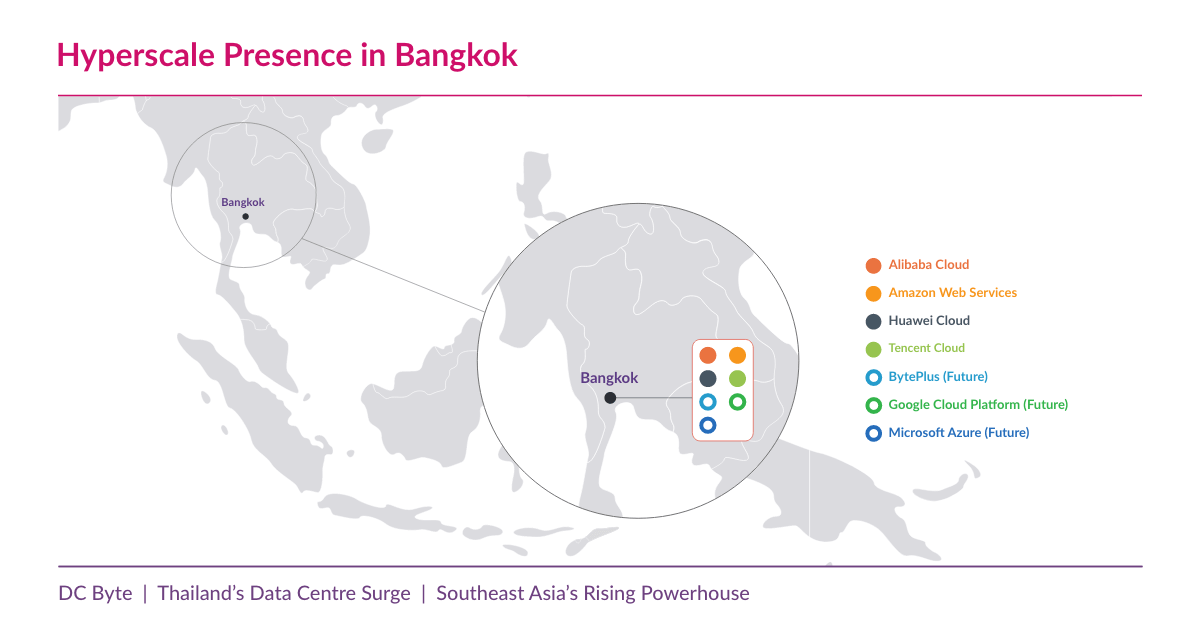

Bangkok’s transformation into a hyperscale-ready market has been fueled by major announcements from AWS, Google, Microsoft, and leading Chinese cloud providers such as Huawei, Alibaba, and Tencent. Bytedance’s 8.8 billion USD commitment, AWS’s 5 billion USD investment, Google’s 1 billion USD facility in Chonburi, and Microsoft’s first Thailand cloud region underscore strong long-term confidence in the market.

In parallel, operators such as STT GDC, Equinix, DAMAC Digital and Evolution Data Centres are establishing or expanding their presence. Between 2019 and 2024, total IT capacity in Bangkok grew more than twentyfold, with pipeline capacity recording a five-year CAGR of around 40%.

Eastern Economic Corridor: The Next Frontier

The Eastern Economic Corridor (EEC) is rapidly evolving into Thailand’s primary zone for large-scale deployments. Chonburi and Rayong offer clear advantages for hyperscale operators, including land availability, competitive pricing, and supportive infrastructure. Both provinces also benefit from proximity to major ports, manufacturing hubs, and transport links, giving them an edge for high-capacity, latency-sensitive workloads.

Chonburi, in particular, has become a focal point for the largest upcoming builds. Landmark projects such as DayOne’s 120MW Chonburi Tech Park and Bridge Data Centres’ planned 200MW campus will significantly boost the region’s live capacity over the next few years. This growth is prompting both international and domestic operators to secure capacity well in advance.

Cloud and AI Fueling Demand

Cloud remains the foundation of Thailand’s data centre growth story, accounting for roughly 38 percent of total capacity as of Q1 2025. Deployments from major global hyperscalers are shaping the market’s evolution and driving immense growth. AI demand is rising sharply, climbing from 20% of capacity in 2024 to 28% in early 2025, driven by training workloads, large language models, and data-intensive enterprise applications.

Private sector initiatives are also helping the market prepare for AI workloads. Partnerships with Siam AI Corporation, a NVIDIA cloud partner, are enabling the design of infrastructure optimised for high-density, AI-ready deployments. Together, these efforts position Thailand to serve as both a regional cloud hub and an emerging AI innovation centre.

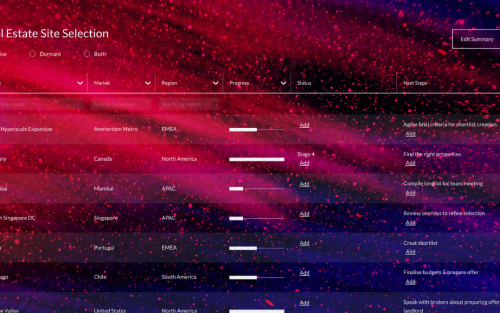

Access the Full Market Analysis

This blog offers a snapshot of Thailand’s data centre surge. The complete analysis draws on DC Byte’s proprietary data and on-the-ground intelligence to help operators, investors, and planners understand where each sub-market stands and how to act on emerging opportunities.

Download the full report for detailed capacity breakdowns, project timelines, and strategic insights into Southeast Asia’s next breakout data centre hub.

For organisations seeking local market intelligence with tailored insights, speak to our expert analyst team today.