By Radmila Blazheska – Marketing Director, DC Byte

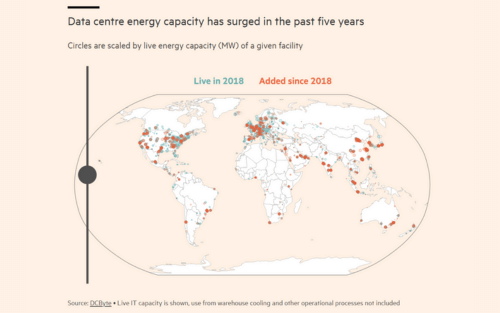

In my role as Marketing Director at DC Byte, I have had a front-row seat to one of the fastest infrastructure expansions in modern history. The data centre industry is no longer simply growing, it is scaling at a velocity that is reshaping markets, capital flows, and national energy strategies.

Over the last 24 months, a profound shift has occurred: demand has decoupled from supply. Hyperscale and AI infrastructure needs are rising at record speed, but the ability to deliver new powered capacity is increasingly constrained by grid availability, energy policy, and planning complexity. The result? Data centres have become one of the most competitive asset classes on earth, and a defining pillar of the global digital economy.

Our DC Byte 2025 Global Data Centre Index shows that global take-up grew ~30% year-on-year, driven by AI workloads, hyperscale expansion and growing sovereign cloud requirements. That isn’t cyclical growth. That’s an industry reshaping its future.

As DC Byte CEO Bernard Johnson recently said:

“Data centres have moved from being passive infrastructure to becoming active engines of growth. They’re not just responding to digital demand—they’re shaping it. In today’s economy, the presence and performance of data infrastructure increasingly determine a region’s competitiveness, innovation potential, and resilience.”

Power Is Now the Real Product

For the first time in industry history, power access has overtaken land as the biggest bottleneck in delivery. In highly developed regions, including London, Dublin, Frankfurt and Northern Virginia, grid limitations now shape the market more than customer demand.

In Northern Virginia, still the world’s largest data centre hub, zoning changes and grid congestion are pushing growth into new corridors like Prince William County and Henrico. Meanwhile, Ireland has seen grid allocations frozen or restricted since around 2021 and parts of Germany are now facing long lead times for new substations.

Our data confirms it: “power-led site strategy” has replaced “location-first site selection.”

As Siddharth Muzumdar, Research Director at DC Byte, explains:

“The viability of infrastructure projects now hinges on energy availability. Power is no longer a constraint — it’s the gatekeeper”

This shift is transforming investment, market competition, procurement, and even corporate storytelling. The most successful operators and investors are no longer selling location, they’re selling .

The New Supply Reality

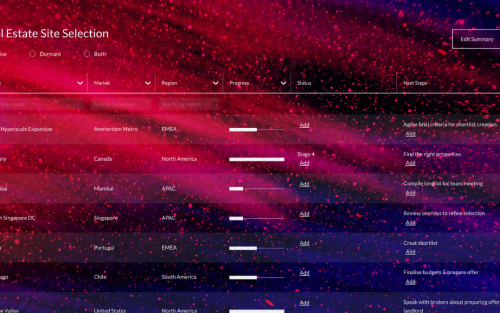

Development pipelines today must be measured by delivery probability, not announced capacity. At DC Byte, we classify supply exposure into verified stages:

DC Byte Supply Classification Description

- Live IT Capacity: MEP fitted out and operational

- Under Construction IT Capacity: Undergoing MEP fitout

- Committed IT Capacity: All necessary elements for development secured, including land, power, permits and in some cases an anchor tenant.

- Early Stage IT Capacity: Yet to secure necessary elements for development

Here’s why this matters: since 2019, committed supply has grown more than sixfold, but under construction supply is slowing in mature markets due to power delays. This is creating a growing gap between intent and delivery.

Why Demand Is Accelerating So Quickly

There are five major forces driving historic levels of demand:

- AI Infrastructure: Unprecedented power density requirements

- Public Cloud Expansion: Still the largest live consumer of space

- Digital Sovereignty: Nations mandate local compute zones

- Latency-Driven Content: Gaming, streaming & video processing at scale

- Enterprise Migration: Hybrid strategies push traffic to regional hubs

AI is additive, not a replacement for cloud demand. The market isn’t rotating from cloud to AI; it’s expanding to accommodate both. This introduces a “dual surge effect” – stacked demand waves hitting the same constrained power infrastructure.

Global Growth Corridors – Markets That Matter Now

Compute demand is now a geopolitical priority. Governments, energy providers, and investors are competing to attract digital infrastructure at record scale. Strategic growth corridors, based on DC Byte market analysis, include:

United States: The Global Epicentre of Compute

The U.S. continues to dominate with Northern Virginia, Georgia, Texas, Ohio, Phoenix and Pennsylvania leading expansion.

- Georgia + Pennsylvania now exceed 27.5 GW of total capacity

- Nuclear-supported power improves long-term energy certainty

- AI megacampus planning shaping pipeline density

Canada: The Sustainable Power Advantage

Canada has quickly become a leading AI infrastructure alternative, driven by its cooler climate, which improves sustainability metrics, and initiatives in clean energy transition.

- 10.4+ GW of total capacity

- 93% concentrated in Toronto, Montreal and Alberta

- Hydropower = lowest carbon AI build in North America

Southeast Asia: APAC’s New Hyperscale Frontier

Singapore’s moratorium forced capacity spillover into Johor and Batam, but Bangkok is the breakout story.

- Bangkok now exceeds 2.5 GW in total capacity

- Cloud accounts for ~38%, AI rising from 20% to 28%

- Eastern Economic Corridor (EEC) drawing hyperscale campus interest

As our APAC Research Manager, Jingwen Ong notes:

“Southeast Asia is growing in relevance as a frontier subregion with its own set of strengths; the availability of resources and thus low cost of development has attracted significant hyperscale interest. This is especially true for location-agnostic AI workloads.”

Europe: Strong Demand Meets Power Reality

Europe’s Tier 1 markets still anchor global capacity London, Frankfurt, Amsterdam, Paris, and Dublin remain essential to hyperscale and enterprise strategies. But grid allocation has become the defining challenge in these metros. Power access limitations have opened a surge in adjacent European hubs:

Rising EU Markets and Why They’re Growing

- Madrid & Milan: Grid capacity + enterprise demand

- Berlin & Vienna: Government + cloud expansion

- Warsaw: Central European growth corridor

- Nordics (Sweden, Norway, Finland): Lowest energy cost + sustainability advantage

European governments are also stepping in to treat data centres as “strategic digital infrastructure.” Expect to see more regulated energy partnerships, green power incentives, and sovereign AI hosting mandates across the region.

Middle East & Africa: The Next Acceleration Zone

While early in comparison to U.S. and APAC arcs, the Middle East & Africa is rising as a compute+energy powerhouse. Hyperscalers are expanding in Saudi Arabia, UAE, and Israel, while Africa is seeing the first wave of carrier-neutral hyperscale builds in South Africa and Kenya.

The long-term driver? Population and AI-led enterprise transformation.

Why This Growth Wave Is Different

This isn’t just another cycle. It’s a multi-decade infrastructure overhaul.

Three market truths define this moment:

- Power is the constraint, not demand

- Markets are fragmenting into power-rich and power-poor zones

- Investors now prioritise grid feasibility over land availability

As Bernard Johnson, CEO of DC Byte, puts it:

“In this market, megawatts have become a strategic currency. The operators who can bring power to market fastest will define the next decade of digital infrastructure.”

Market Intelligence Now Drives Competitive Advantage

In a high-velocity market, bad information has become a real financial risk. Too many operators announce capacity they cannot deliver. Too many investment decisions rely on historic averages instead of grid realities.

This is why we built DC Byte, to create clarity in a complex market.

As Siddharth Muzumdar, Research Director at DC Byte, says:

“There is no data centre strategy without data. Market intelligence isn’t a report anymore, it’s a requirement for execution.”

At DC Byte, our teams conduct:

- 29,000+ quarterly site validations

- 2,400+ in-person inspections

- Tracking of 8,000 data centre facilities

- Full pipeline tracking from early-stage to live

This level of verification allows us to separate announced capacity from deliverable capacity, a critical distinction in today’s market.

From Marketing to Market-Making

As a marketer in this industry, here’s what I’ve learned: the companies that win are not the loudest, they are the clearest.

Customers don’t want slogans. They want signal in a market full of noise. The job today isn’t to hype scale, it’s to prove feasibility.

That means:

- Show where power is secured

- Publish grid timelines, not just build phases

- Reveal data provenance, not vague claims

- Offer market navigation, not promotion

We have entered a power-first era in digital infrastructure. The future will be shaped by the countries that manage grid strategy, the operators who master power procurement, and the investors who move with verified insight—not speculation.

At DC Byte, our mission is simple: help the world build digital infrastructure intelligently, sustainably, and at scale. In a market moving this fast, clarity isn’t an advantage, it’s a necessity.

If your team is planning expansion, evaluating markets, building AI capacity, or allocating capital in digital infrastructure—we should talk.

DC Byte provides trusted market intelligence for: