February 17, 2026

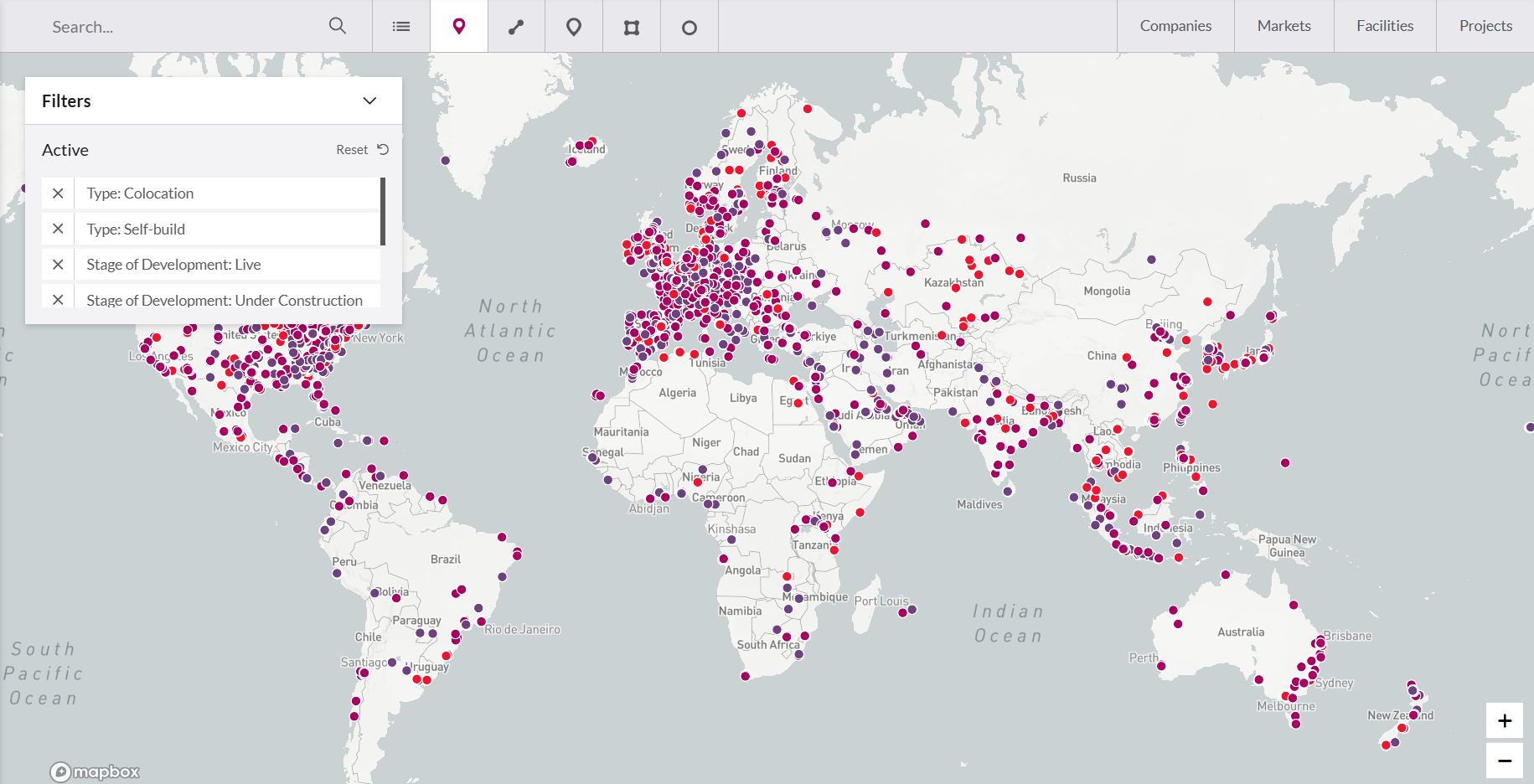

EMEA’s hyperscale narrative remains structurally anchored in the FLAP-D markets (Frankfurt, London, Amsterdam, Paris, and Dublin). These hubs represent the primary centers of gravity for interconnection density and cloud deployment.

However, the competitive moat is shifting. Market advantage is no longer derived from mere demand adjacency; it is now defined by deliverability under systemic constraint. Power procurement, planning pathways, and site readiness now dictate deployment velocity as much as customer proximity. For sophisticated observers, the primary signal is no longer live capacity, but the committed pipeline relative to operational supply.

“The pivot in EMEA conversations is clear: we are moving from demand mapping to execution viability. The leading indicator is not current capacity, but the formation of the committed pipeline—specifically, how much is pre-let and which delivery models are being utilized to mitigate execution risk.” — Scott Roots, Sales Director, EMEA, DC Byte.

London and Frankfurt: Convergent Fundamentals, Divergent Conversion Risks

While distinct, London and Frankfurt share a strategic role as the twin pillars of European finance and enterprise. Both anchor deep connectivity ecosystems with durable demand drivers. Their market maturity is evidenced by high pipeline-to-operational capacity ratios, signalling a massive volume of supply currently queued for delivery.

Pipeline-to-operational ratio:

London – 118%

Frankfurt – 144%

The delta between pipeline and operational capacity serves as a proxy for execution risk. A widening gap suggests that while capital intent is robust, delivery is bottlenecked by grid access and regulatory friction.

- London: A critical signal here is the resurgence of hyperscaler self-build intent. This shift toward owned capacity suggests that “control over certainty” has become the premium currency in high-constraint zones. We also see a geographic migration toward surrounding corridors, following availability zone logic as central clusters reach saturation.

- Frankfurt: While the financial hub fundamentals remain intact, the delivery signal is more fragmented. Frankfurt’s 278% ratio implies a significant lag between commitment and commissioning. Consequently, Germany’s growth can no longer be viewed through a monocentric lens; capacity is increasingly distributed across secondary metros where land-power-planning profiles offer a clearer path to conversion.

Paris and Amsterdam: Analyzing Pipeline Mechanics and Delivery Control

Paris and Amsterdam are frequently tethered in market commentary, yet a granular analysis reveals diverging mechanics. However, the delivery control models tell a different story.

Pipeline-to-operational ratio:

Amsterdam – 51%

Paris – 151%

- Amsterdam: The market faces significant perception risk. Large-scale campus developments often dominate the narrative, masking the underlying mix. Realistically, supply delivery is governed by external city-core dynamics, where the ability to execute hinges on specific partner alignments and peripheral grid availability.

- Paris: This market displays a more diversified pipeline spread. A multi-player landscape offers greater resilience against localised constraints, as it avoids reliance on a single procurement route. Furthermore, France’s low-carbon generation mix provides a favourable macro narrative, though local grid bottlenecks remain the ultimate arbiter of execution.

Dublin: The Outlier Clarifying the Constraint Narrative

Dublin remains the definitive case study for constraint-reshaped behavior. As a market dominated by hyperscale self-builds, it illustrates how grid uncertainty forces more decisive, upstream commitments. In an environment of extended timelines, delivery sequencing becomes a high-stakes exercise in risk management, fundamentally altering the traditional operating model.

Beyond FLAP-D: Corridor Diversification as Portfolio Alpha

While FLAP-D remains the core, hyperscale growth is increasingly portfolio-based. To mitigate the risks of hub saturation, attention is pivoting toward “corridor thinking”:

- The Mediterranean Corridor: Offers a strategic hedge with differentiated connectivity and regional demand access.

- The Nordic Corridor: Emerging as a sustainable alternative for power-intensive workloads, providing optionality in delivery resilience.

These markets are not substitutes for FLAP-D; they are strategic complements designed to ensure portfolio-wide deliverability when traditional hubs face planning or power gridlocks.

Strategic Takeaway: To accurately assess EMEA expansion, one must move beyond “live” data. Precise assessment requires a structured view of the committed pipeline and the delivery model mix to identify where capacity will actually reach operational status next.

London Data Centre Market Spotlight

A detailed view of one of EMEA’s most constrained hyperscale hubs, including project pipelines and where development is concentrating beyond the urban core.

Frankfurt Data Centres 2025 Infographic

A visual snapshot of a core European interconnection market, showing the market profile and the conditions shaping delivery

Mediterranean Sea Markets Spotlight

A corridor-level view of emerging growth zones, including market context and signals shaping where capacity may land beyond the most saturated hubs.

The Hyperscale Build Race

A global view of how power, policy, leasing, and delivery speed are reshaping hyperscale development, and what pipeline signals reveal about where capacity is likely to clear next

Bringing It Back to Decision-Making

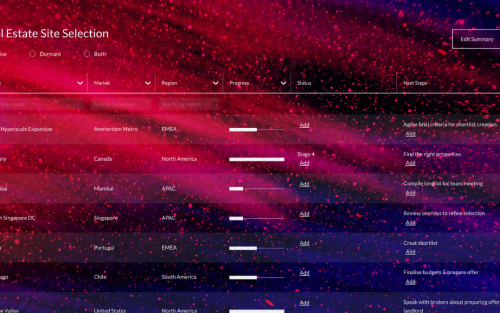

DC Byte tracks data centre markets across EMEA in real time, combining facility-level intelligence, project pipelines, and analyst context to support more precise assessment of delivery conditions.

For organizations evaluating expansion, tracking competitors, or assessing where capacity is most likely to reach operation next, the platform provides a structured view of live capacity, committed pipeline, and delivery model mix at market, metro, or project level.

If your planning depends on separating announced capacity from deliverable capacity, you need better visibility on data centre markets, not bigger bets. Book a demo with our team to explore our Market Analytics, where we capture global data centre capacity by market and development stage.