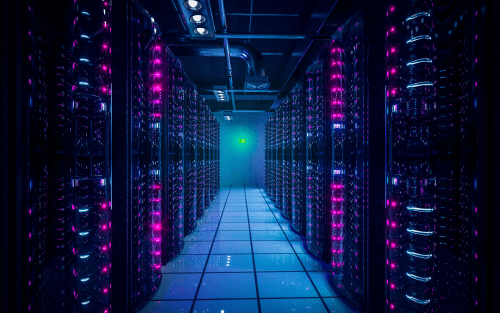

The global data centre industry is facing a mounting delivery gap. In 2024, demand for capacity rose by 30%, but the pace of new construction is no longer keeping up. Across mature markets, power constraints and permitting delays are slowing project delivery. Even as committed projects hit record highs, many remain stalled in planning.

A growing number of facilities are now being pre-leased years ahead of delivery. Entire projects are sold before construction begins. This is not just a shift in leasing strategy. It is a warning sign that the global digital infrastructure pipeline is struggling to keep up with demand.

Capacity Is Growing on Paper, Not on the Ground

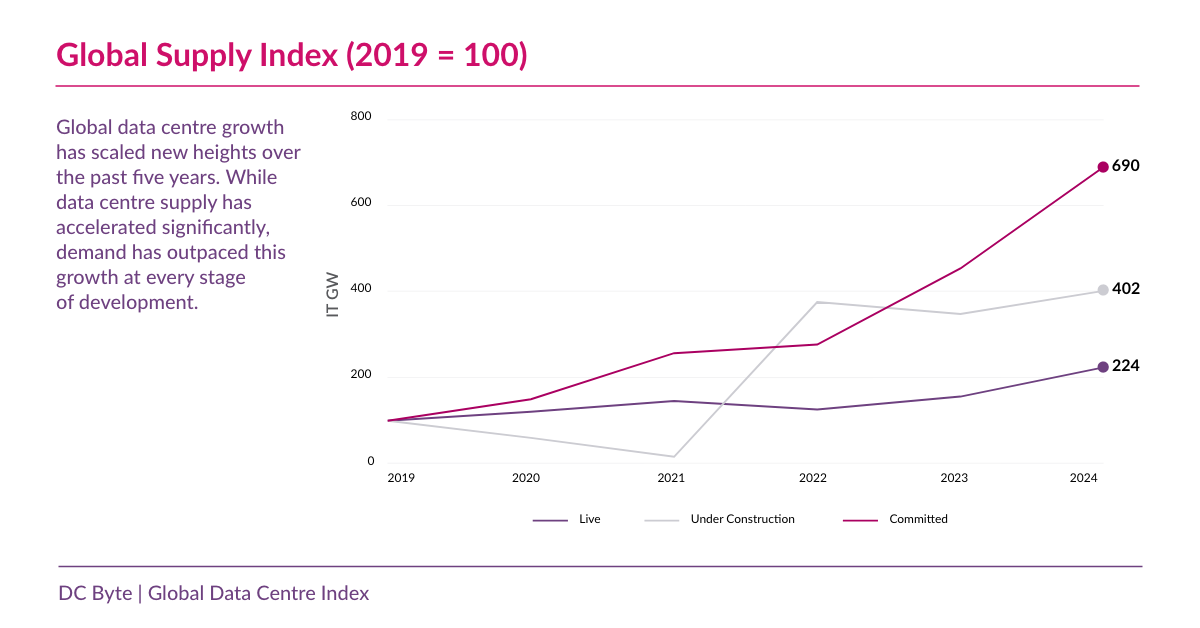

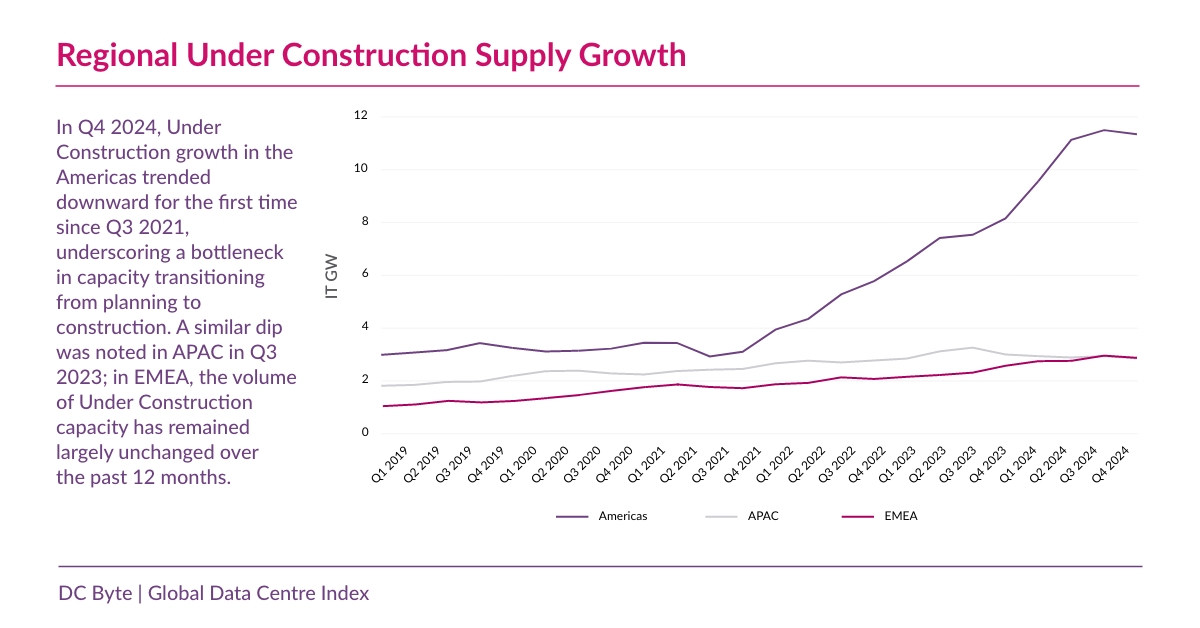

The volume of committed supply, defined as projects with secured land, power and planning permissions, has grown more than sixfold since 2019. But under construction capacity is no longer tracking upward at the same rate. The latest Global Data Centre Index shows a marked slowdown in build activity in several key markets.

In the United States, where development once surged ahead of demand, new construction levels have begun to flatten. Europe shows similar signs of strain, particularly in London, Dublin and Frankfurt. Even in high-growth regions like Southeast Asia, the volume of live delivery is falling behind the rate of announcements.

This is not a market cycle. It is a structural constraint.

“The market is not cooling. It is overcommitted and underdelivered. In the US especially, we’re seeing a real tension between intent and execution,” says Colby Cox, Managing Director, Americas at DC Byte. “Projects are being leased before construction starts, but grid delays and permitting hold-ups are pushing delivery further out. This isn’t a demand problem. It is a development bottleneck. Operators who can bring capacity online, not just announce it, will be the ones who win.”

Power Constraints Are Redefining Site Viability

Power availability is now the defining factor in site development. In several major metros, data centre growth is being capped not by investor appetite or customer demand, but by the local grid. Delays to substation approvals and connection infrastructure have created multi-year bottlenecks.

Permitting is also becoming a friction point. Planning authorities in key global markets are contending with more complex applications, larger footprints and more vocal local opposition. This is slowing down even well-capitalised projects, creating a lag between intent and delivery.

Alternative solutions such as battery storage or microgrids are being explored as temporary fixes, but they cannot support full-scale deployment. These are workarounds, not long-term answers.

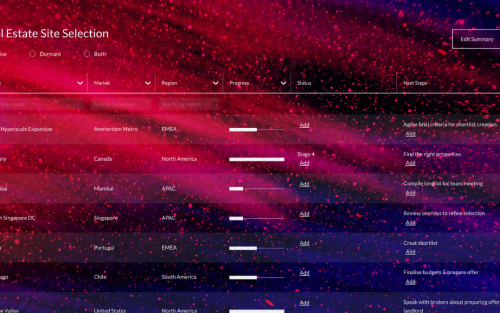

Leasing Models Are Moving Upstream

Hyperscalers and cloud providers are now securing capacity much earlier in the development cycle. Pre-construction leasing has grown rapidly. In some cases, end users are reserving space three to four years in advance to ensure delivery in high-demand markets.

At the same time, operators are facing their own pressures. Alongside the acceleration in pre-leasing, they must also contend with long development timelines in certain markets. In Tokyo, for example, power constraints and limited construction resources mean it can take several years to bring capacity online. The combination of early commitments and extended delivery periods is contributing to an early supply squeeze, with smaller customers being priced out and colocation availability tightening, especially in Tier 1 cities.

Jingwen Ong, APAC Research Manager at DC Byte, notes: “Across APAC, we’re seeing leasing strategies shift, but the pace and pressure vary. In Tokyo, anchor tenants are locking in space earlier and in larger chunks, which is squeezing availability. In contrast, markets like Johor or Jakarta still offer more flexibility, but that’s starting to change. The gap is narrowing, and smaller customers are the ones feeling it first.”

New Markets Are Filling the Delivery Gap

As grid constraints and land scarcity reshape development strategies, operators are targeting new growth corridors. Markets such as Indiana and Alberta have emerged as hyperscale hotspots, offering available land, more favourable permitting, and scalable energy options.

These locations are not just secondary choices. They are becoming key destinations for AI and cloud infrastructure. Projects like Wonder Valley in Alberta, set to become one of the world’s largest AI campuses, reflect the scale of this shift.

When Infrastructure Falls Behind

The risk for operators, end users and investors is clear. Infrastructure is no longer scaling at the pace digital services require. The delivery gap is real and it is growing.

Power constraints, delayed permitting and constrained land supply are now core challenges for the industry. Without changes in utility planning, regional regulation and long-term energy investment, the gap between committed and operational capacity will continue to widen.

Why the Market Needs to Act

This is no longer just a story about delays. It is a question of competitiveness. Operators, developers and investors are being judged not only on how much capacity they can commit, but on how reliably they can bring it online.

Over the next two years, the strain on delivery will become more visible. Many of the hyperscale projects announced in 2023 and 2024 are now approaching the critical stage where construction needs to begin. Those who have secured power, land and permits will be in a position to lead. Others may be forced to pause or rework plans as grid timelines stretch and permitting challenges continue.

Pre-leasing will continue to move earlier in the development cycle. Customers will prioritise partners who can offer certainty around timelines and activation. In highly competitive markets, smaller users may struggle to access the capacity they need as operators prioritise large-scale anchor tenants.

Understanding where and when supply can realistically come online is becoming just as important as knowing how much capacity exists on paper.

DC Byte provides the global data centre intelligence needed to make faster, better-informed decisions. Our platform brings together project-level data, supplier insights and primary research across more than 8,000 tracked facilities worldwide. Whether you’re looking to enter a new market, benchmark against competitors or identify early opportunities, we offer the clarity and context to act with confidence.

Want to explore the data behind this analysis or speak to a member of our team? Get in touch to discuss how DC Byte can support your market strategy.