November 27, 2025

The hyperscale market is entering a new phase defined by constraints in power, land and regulation. As AI adoption accelerates and cloud platforms continue to scale, the physical and policy limits of major data centre hubs are reshaping how and where hyperscalers plan their next wave of build activity. DC Byte’s latest global analysis tracks these developments across more than 8,000 facilities, revealing how the geography of hyperscale growth is evolving in response to mounting infrastructure pressure.

Power Scarcity Reshapes the World’s Largest Data Centre Hubs

Across the world’s most established markets, power availability has become the most immediate challenge. Grid constraints are tightening in Northern Virginia, Frankfurt and Singapore, with vacancy in some mature hubs falling below 1%. These locations remain essential for connectivity and cloud service density, yet the combination of limited grid headroom and increasingly complex regulations has made new delivery more difficult. Hyperscalers are responding by moving earlier in the development cycle, securing power and land up to 24 to 36 months before delivery. Entire campuses are being reserved before construction begins, shifting pre-leasing from a late-stage commercial milestone to an early strategy for securing long term capacity.

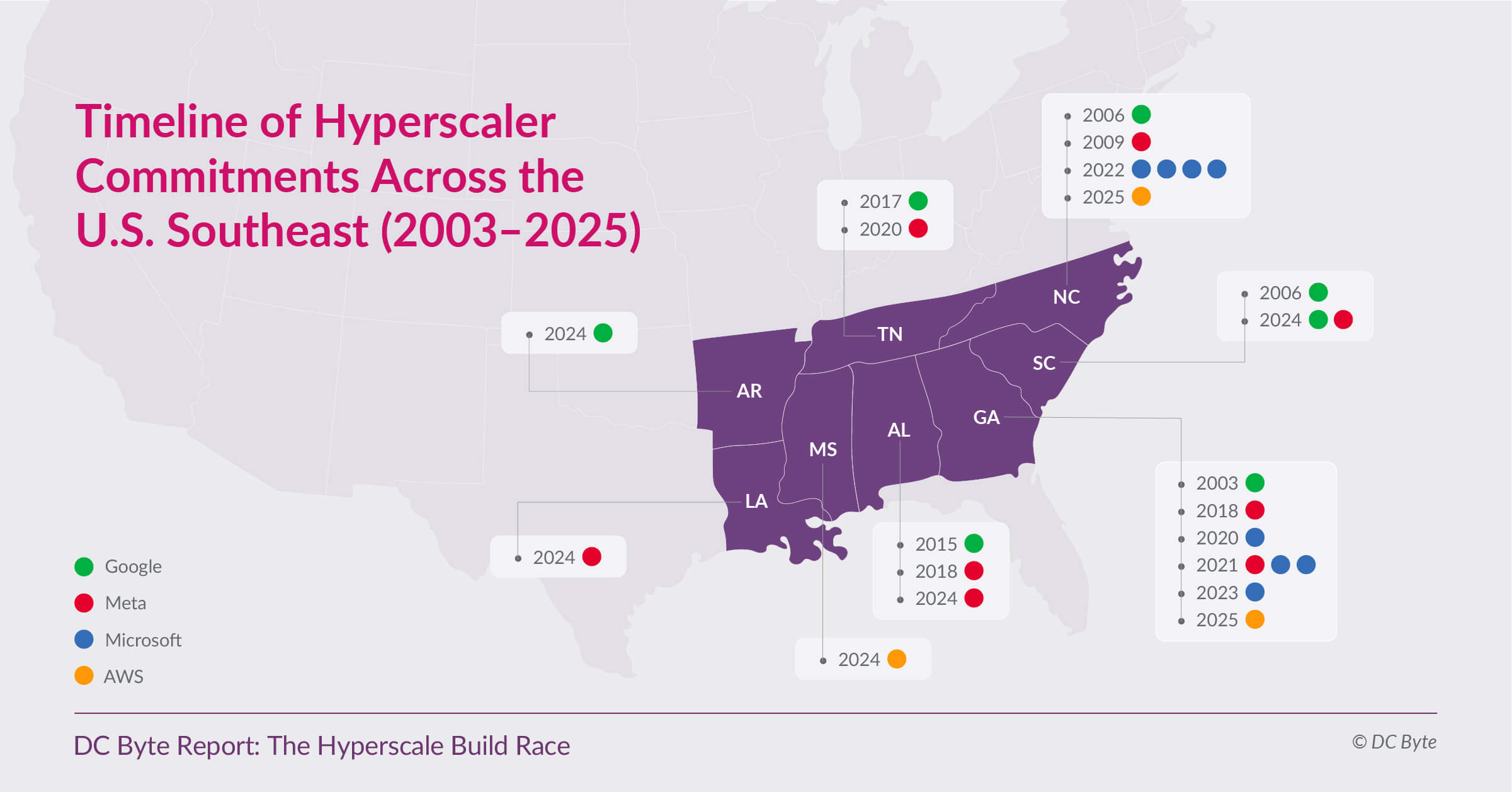

New Growth Corridors Emerge in the United States Southeast

As these hubs reach saturation, growth is redirecting into regions with stronger power availability and more predictable planning. In the Americas, the United States Southeast has become one of the fastest-growing subregions for hyperscale commitments. States such as Georgia, North Carolina and Alabama combine available land with utility engagement and state level incentives, creating development environments that support faster delivery. This shift marks a clear diversification within the broader US market as hyperscalers look beyond Northern Virginia’s constrained grid.

Europe Widens Its Hyperscale Footprint as FLAP-D Constraints Deepen

A similar pattern is emerging in EMEA. The FLAP-D markets continue to serve as core hubs, but power scarcity, land pressures and extended approval timelines are prompting hyperscalers to broaden their regional footprints. Southern and Central Europe are absorbing redirected demand, with Italy, Spain and Poland among the markets attracting sustained activity. These regions offer clearer permitting routes and more available capacity, making them increasingly important in long term expansion planning.

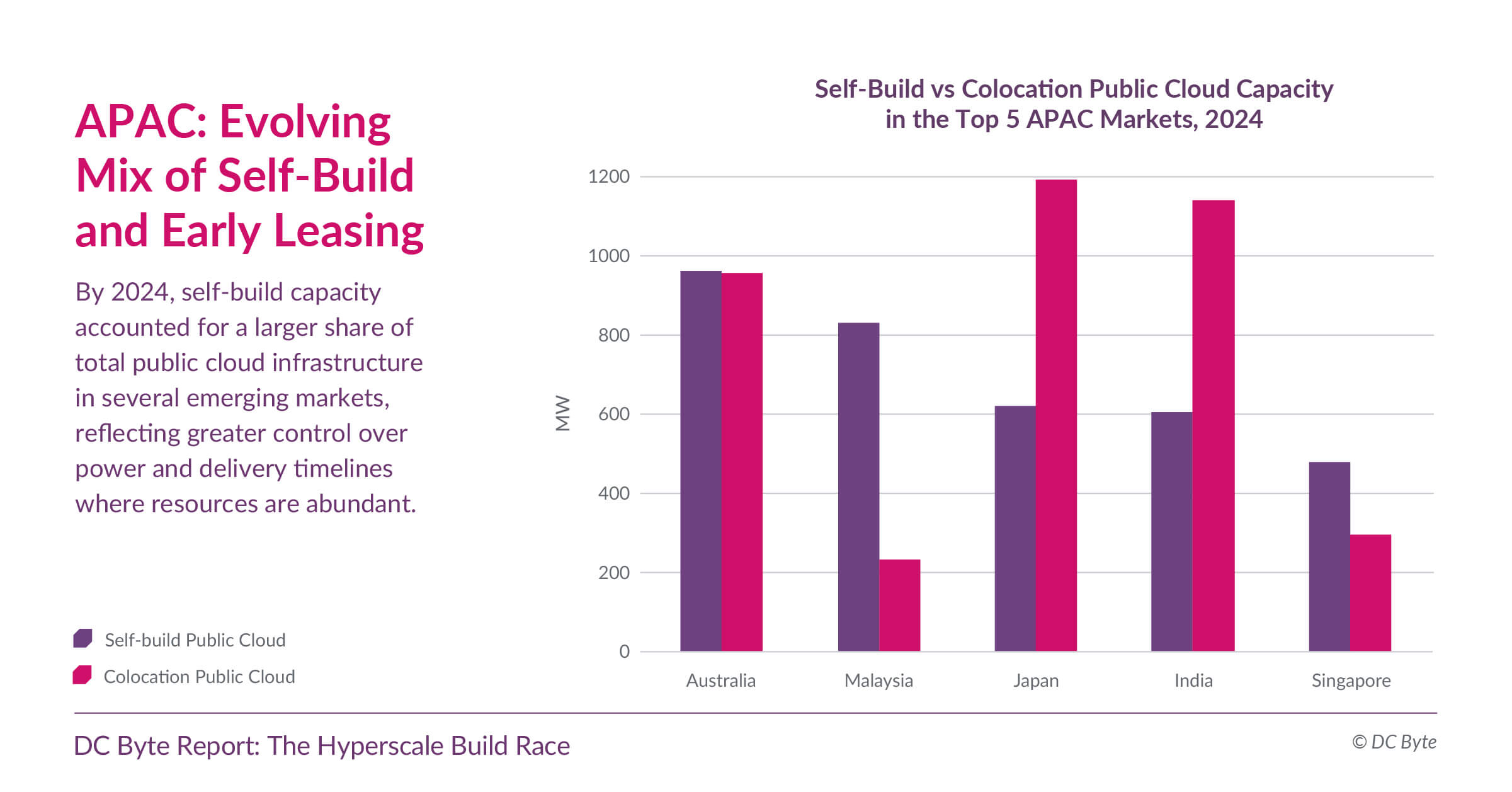

APAC Enters a New Phase of Regional Hyperscale Expansion

Asia Pacific is undergoing its own rebalancing. Hyperscale capacity in the region has grown at a five year compound annual growth rate of 32.9%, making APAC one of the fastest expanding regions globally. Traditional hubs such as Singapore, Tokyo, Hong Kong and Sydney remain central to regional networking, yet rising constraints have encouraged hyperscalers to diversify. New clusters in Johor, Jakarta, Bangkok and key metros in India have become strategic focal points due to available land, improving grid access and supportive policy environments designed to accelerate digital infrastructure investment.

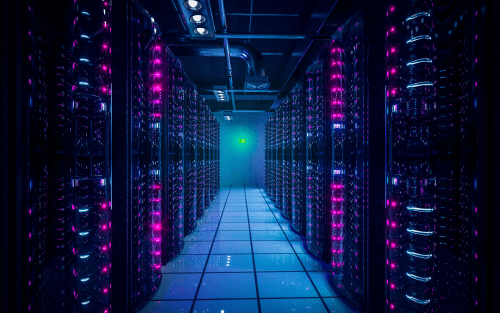

AI Infrastructure Transforms Delivery Models and Supply Chains

These regional shifts are occurring alongside significant changes in delivery models. AI-driven workloads require higher power densities and more specialised infrastructure. Longer lead times for electrical equipment and broader supply chain challenges are contributing to extended construction timelines. In response, operators and suppliers are adopting modular build approaches, expanding local manufacturing footprints and deepening partnerships with utilities to secure long term power availability. Delivery speed, cost predictability and resilience have become as important as location in determining project viability.

The combined effect is a global build race defined less by geography and more by the interplay of power, policy and planning. Established hubs will remain important, but their future growth will be more selective. Emerging regions that can align grid capacity, regulatory certainty and scalable land availability are set to capture a growing share of hyperscale investment.

As Siddharth Muzumdar, our Research Director notes, the shift is structural:

“Hyperscalers are the decisive force shaping digital infrastructure today. With Hyperscaler Analytics, we’re giving our users the clarity they need to understand and act on that growth through verified, analyst-led insight.”

This view is echoed across our analysis, which shows the strategic weight moving toward regions capable of delivering capacity with greater certainty.

Access the Full Report

These global dynamics are tracked in detail through DC Byte’s Hyperscaler Analytics, which brings together verified insight on hyperscaler activity, presence and expansion patterns across markets. The full report provides deeper regional analysis across the Americas, APAC and EMEA, helping decision makers understand how power, policy and delivery certainty are reshaping the future of hyperscale development.

For organisations seeking local market intelligence with tailored insights, speak to our expert analyst team.