Market Analysis: Georgia & Pennsylvania Surging in the U.S. Data Center Race

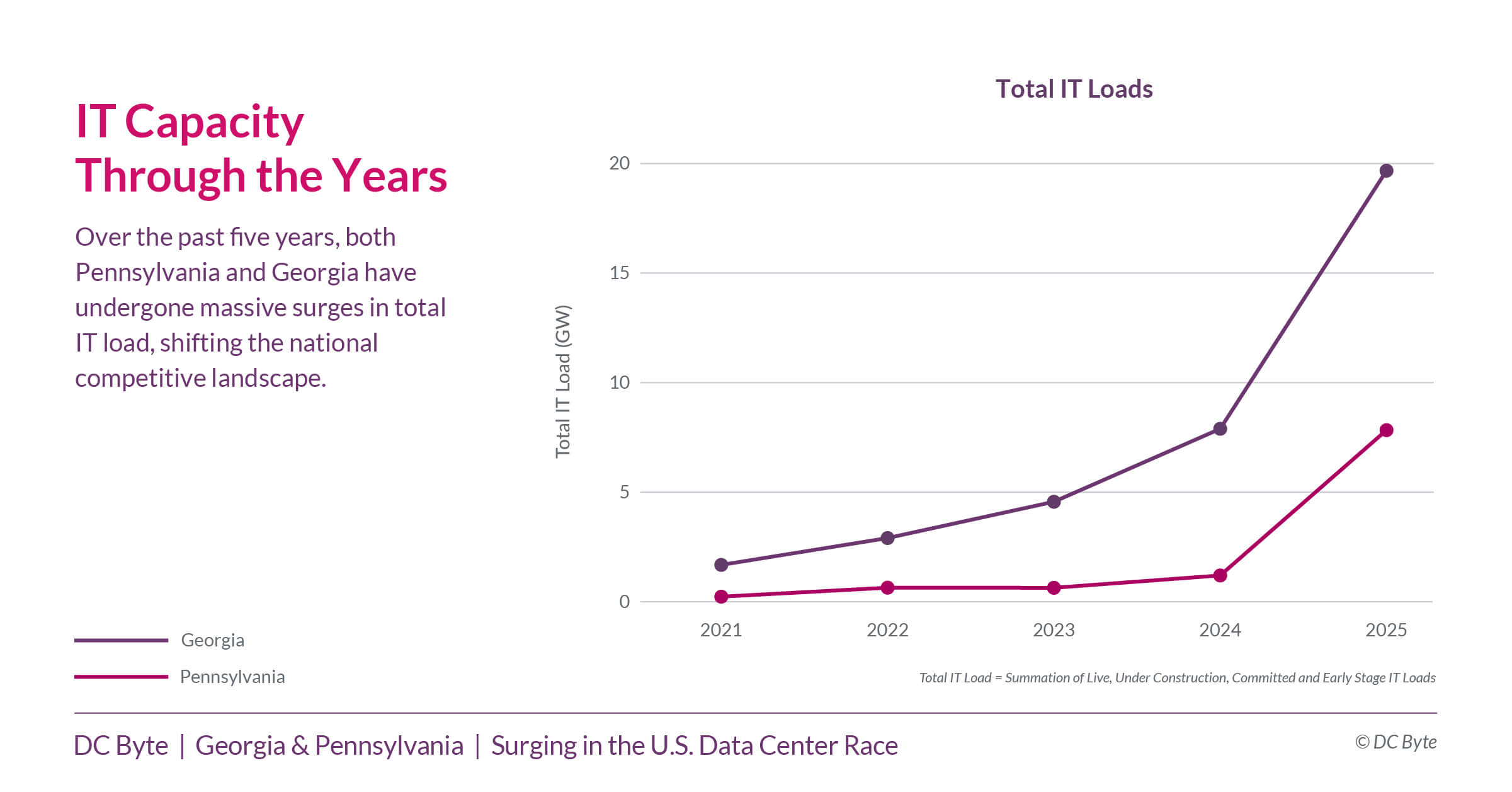

Georgia and Pennsylvania are quickly emerging as two pivotal data center markets in the United States. Together, their IT capacity now exceeds 27.5 GW, placing them among the fastest-growing regions nationally. Strategic advantages in power availability, industrial land, and policy support are drawing hyperscalers and colocation providers to scale at unprecedented speed.

Over the past four years, both markets have transitioned from secondary options to national contenders. Georgia has surged ahead with aggressive capacity additions, while Pennsylvania has leveraged its energy mix and strategic location to capture hyperscale investment.

As Alexandra Desseyn, Americas Research Manager at DC Byte, notes:

“Georgia’s rapid build-out highlights how quickly markets can overheat when power and land converge without long-term planning. At the same time, Pennsylvania is showing how energy diversity and supportive policies can reposition a state from secondary to strategic. For operators, the lesson is clear: sustainable growth will be defined less by speed and more by alignment between infrastructure, regulation, and energy security.“

Explosive Growth Across Both States

Georgia’s IT load expanded from 1.7 GW in 2021 to 19.7 GW in 2025, nearly tripling in the past year alone. Early-stage capacity has reached 6.7 GW in colocation and 5.3 GW in hyperscale developments, fueled by a wave of large-scale projects.

Pennsylvania, meanwhile, has grown from 0.2 GW in 2021 to 7.8 GW today, driven by wholesale colocation and rising hyperscale commitments from major cloud operators.

Sub-Markets to Watch

In Georgia, Atlanta’s core market is expanding outward. South Atlanta leads with 9.1 GW of planned capacity, while West Atlanta accounts for 2.7 GW, Northwest Atlanta 2.6 GW, and East Atlanta 1.9 GW. This suburban spread reflects both rising land costs and transmission constraints closer to the city.

Pennsylvania’s data center landscape is concentrated in two clusters: Pittsburgh, with 2.6 GW of IT load, and Philadelphia, with 0.5 GW. Pittsburgh’s access to abundant natural gas and proximity to Midwest and Northeast markets gives it a strategic edge, while Philadelphia leverages dense fiber and industry connections.

Energy and Policy Dynamics

Georgia’s growth has been powered by its nuclear strength, anchored by the Vogtle plant’s 4.5 GW baseload, combined with 10 GW of new capacity additions planned by Georgia Power. However, mounting growth pressures are driving tighter zoning rules, PSC approvals for projects above 100 MW, and local moratoriums.

Pennsylvania has taken a different path, introducing supportive policies such as the Computer Data Center Equipment Incentive Program and the Artificial Intelligence and Data Center Act. These measures, alongside streamlined permitting and the reuse of industrial sites, have made the state increasingly attractive to hyperscalers. Operators are also securing long-term nuclear power purchase agreements, ensuring reliable zero-emissions supply near major plants.

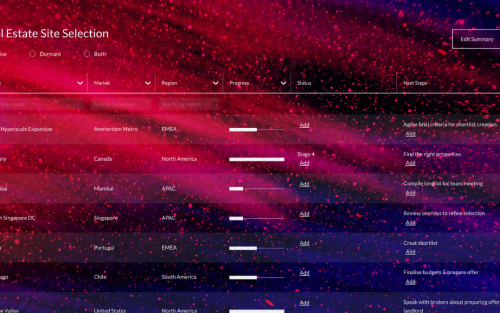

Access the Full Market Spotlight

This blog provides a snapshot of Georgia and Pennsylvania’s remarkable rise. The full Market Spotlight offers detailed breakdowns of IT loads, sub-market activity, and policy timelines, helping operators, investors, and planners understand where each state stands and how to act on emerging opportunities. Download the market spotlight report today.

For organisations seeking local market intelligence with tailored insights, speak to our expert analyst team today.