By Otto Schwimmbeck, Research Analyst at DC Byte

Vienna has long been the beating heart of the Austrian data centre market, hosting over 80% of the country’s IT capacity. Strategically positioned at the crossroads of major fibre routes, it connects Western Europe with Central and Southeastern markets, making it a natural hub for digital infrastructure. Demand is clearly not an issue, with major players, including hyperscalers and colocation providers, showing keen interest. Microsoft’s recent launch of a local cloud region further solidifies long-term confidence in the market.

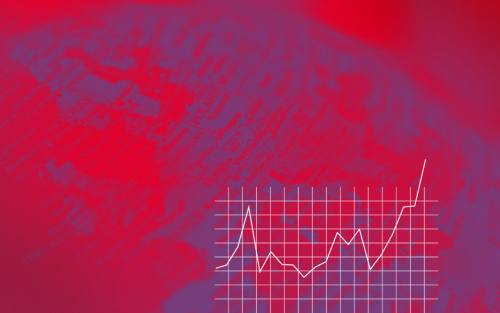

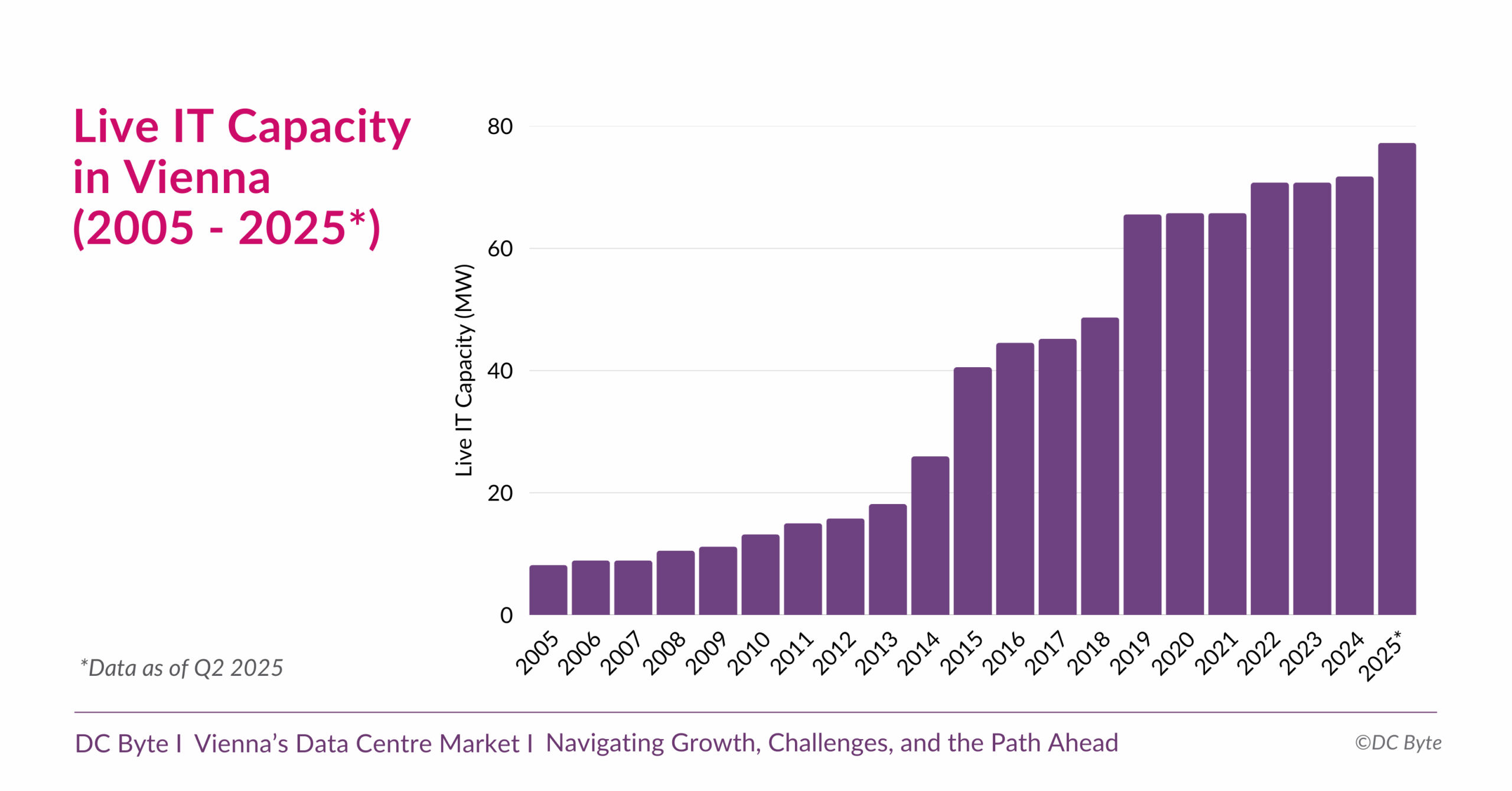

However, despite this strong demand, the Vienna market has slowed down. The core problem isn’t a lack of customer interest, but a series of structural and infrastructure challenges. Power constraints, escalating construction costs, and supply chain delays have significantly slowed the delivery of new capacity. As a result, Vienna is now being overshadowed by other European hubs that are growing at a much faster pace. By 2019, Vienna’s live capacity was expanding rapidly, nearly matching Madrid and Zurich and surpassing Warsaw and Oslo. Since then, however, the market has lost ground as it struggled to overcome key challenges. Today, Vienna’s live capacity is on par with respected hubs such as Barcelona, Geneva, and Munich, but Warsaw is now twice its size and Oslo three times larger. Vienna has also fallen behind Madrid and Zurich.

The city’s future as a key digital gateway will ultimately depend less on customer demand and more on its ability to modernise its infrastructure and overcome these persistent roadblocks.

Vienna’s Strengths – Strong Demand Profile

Vienna’s appeal as a digital hub extends far beyond its role as Austria’s IT capital. Its strategic location on key fibre routes, which link Western Europe with Central and Southeastern markets, makes it a prime location for both local businesses and global colocation providers aiming to serve multiple regions from one central location. The city has a diverse ecosystem with a mix of global operators like Digital Realty, NTT and AtlasEdge, alongside a variety of smaller retail and managed service providers, from next layer to Nessus, all of which continue to attract more investment.

The market’s enduring strategic importance is highlighted by the strong presence of international operators and hyperscalers. The arrival of AtlasEdge in 2024, accompanied by immediate expansion plans, underlined continuing confidence in the market even during a period of slower growth. The most significant milestone came with Microsoft’s 2025 cloud region launch – a clear vote of confidence. AWS and Google also maintain local points of presence to support enterprise needs. Further investment from these providers, potentially with larger-scale deployments, could accompany and incentivise international operator expansion if market conditions improve. Even with limited new capacity recently, interest from large-scale users remains high, demonstrating that the primary bottleneck is energy supply, not a lack of demand.

Vienna’s robust demand profile lays a solid foundation for future growth. If the city can overcome its structural challenges – particularly those related to power and construction – it is well-positioned to attract the next wave of digital investment.

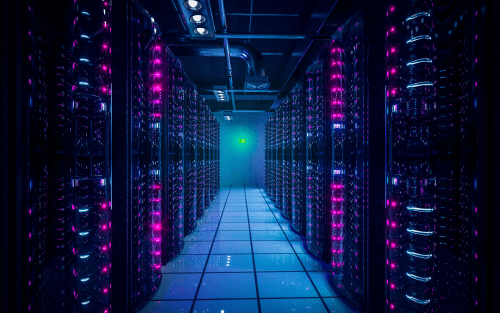

Structural Bottlenecks Are Holding Vienna Back

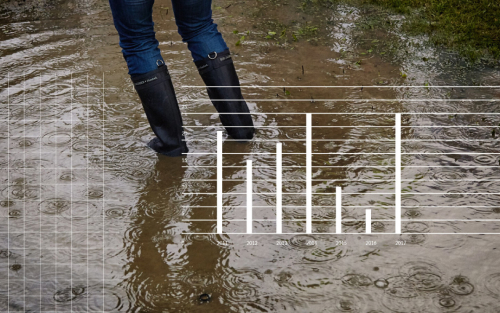

Even with robust demand, Vienna’s data centre market is being held back by a number of structural challenges that make it difficult to convert interest into live capacity. The most significant obstacle is power availability. Operators have reported that securing sufficient grid capacity is increasingly difficult, and where it is available, it often comes at a premium. This makes projects in Vienna less economically viable compared to competing markets. This issue needs to be addressed urgently, especially as Vienna has also bid to host one of the EU’s new ‘Gigafactories,’ which would require enormous power loads and further intensify competition for grid resources.

New builds have also been complicated by rising construction costs and persistent supply chain delays, particularly for critical electrical and mechanical equipment. Microsoft has publicly commented on how these delays have impacted its local developments. While Austria’s planning and real estate laws do not impose specific restrictions on data centres, they also do not provide a fast-tracked or centralised approval process. Developers must navigate a standard real estate process that risks being slow due to local bureaucracy. Whilst power is the number one challenge to the market, we should also not ignore the other challenges.

It should be emphasised that Vienna’s situation is not unique within Europe. Cities like Frankfurt and Zurich have faced similar constraints, including limited land and tight power supplies. In those markets, however, developers have often expanded to areas outside the city centre to secure land and power. In contrast, Vienna’s market has remained concentrated closer to its core, where these bottlenecks are most pronounced, and has not found new pockets suitable for development.

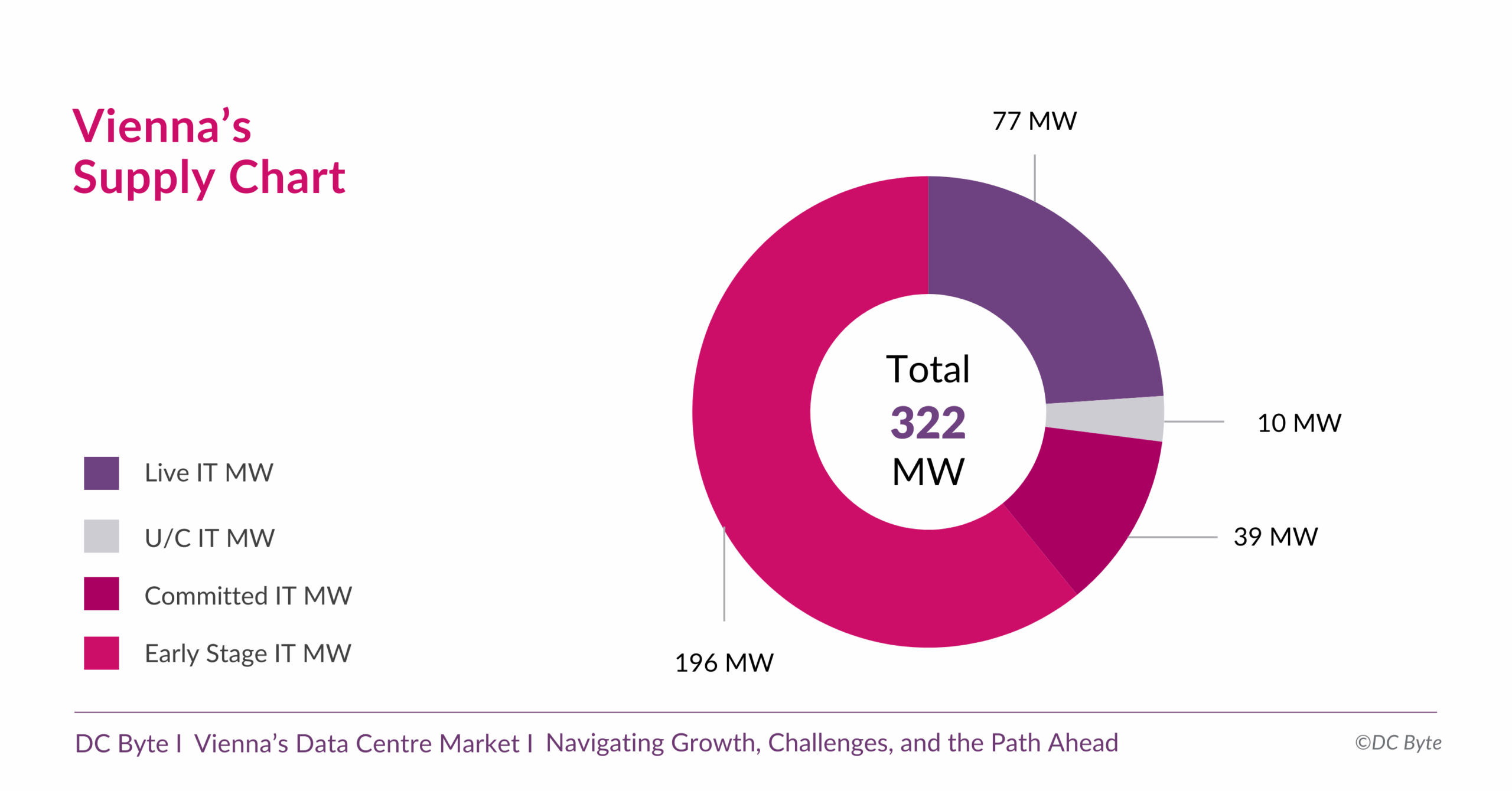

This structural mismatch is clearly seen in Vienna’s supply data. While the total IT capacity exceeds 300MW, roughly two-thirds of this is still in the “early stage” category, meaning it lacks the necessary infrastructure or approvals to come online. The contrast is clear: demand is high, but the market’s ability to supply it is severely constrained. Addressing these bottlenecks – especially grid capacity – will be crucial for Vienna to regain its growth trajectory in the years ahead.

What Comes Next for Vienna?

Vienna is not short of potential catalysts for future growth. Digital Realty is preparing to deliver the first 10MW phase of its VIE13 project next year, AtlasEdge has announced two new facilities (VIE002 and VIE003), and Microsoft is expected to continue expanding its cloud region. These projects would represent a significant boost to supply, but their success and size hinge on whether the city’s underlying infrastructure challenges can be resolved in time.

At the same time, new entrants in the form of other international colocation operators are closely watching Vienna. Persistent market rumours suggest that several are ready to capitalise on rising hyperscaler demand, particularly if AWS and Google decide to expand their local presence. Google already has a foothold in Austria, and its long-discussed landholding near Linz is reportedly finally moving forward. While that specific site is outside of Vienna, any major Google build in Austria would send a strong signal to the market, boosting confidence across the entire ecosystem. Any commitment, from operators or hyperscalers, however, ultimately depends on whether secure power availability can be guaranteed.

Vienna’s data centre market is now at a crossroads. The demand is clearly there, but the pace of future growth will depend on how quickly infrastructure – above all, power – can be aligned with market needs. Other European hubs like Frankfurt and Zurich have demonstrated that growth is possible even under constraints, often by expanding development outwards. Vienna’s own trajectory will be determined by whether the local grid operator, Wiener Netze, can unlock additional capacity or if operators can find new pockets of land to develop around the city. This is all the more pressing given Vienna’s bid to host an EU ‘Gigafactory,’ which would consume vast amounts of power and leave even less for data centre expansion unless the grid is significantly reinforced. Without a resolution, supply risks stalling further; but with one, Vienna has the foundation to rejoin Europe’s top-tier growth markets.

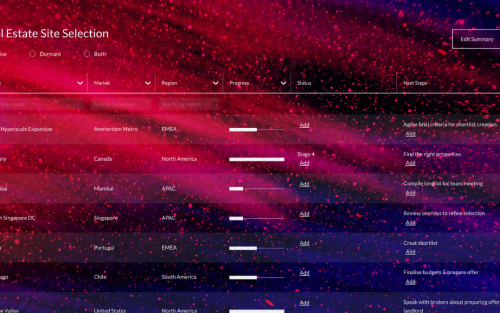

DC Byte tracks Vienna alongside more than 8,000 facilities worldwide, providing the context needed to understand how markets are evolving. Our research combines project-level data with supplier insights to highlight both opportunities and constraints across global hubs.

If you would like to explore the full dataset behind this analysis or discuss how Vienna compares to other European markets, get in touch with the DC Byte team.