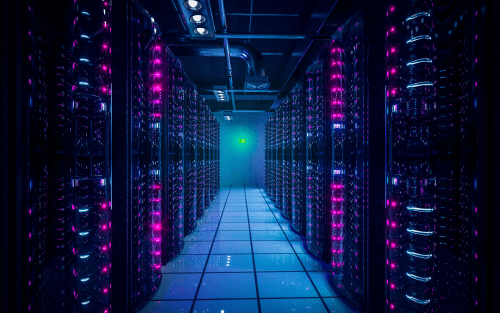

Revisiting the World’s Largest Hub

Long regarded as the world’s data center capital, Virginia is now at a crossroads. Power constraints, higher permitting thresholds, and local opposition are forcing operators to rethink growth strategies and identify new hubs beyond Loudoun County.

Power constraints, tighter zoning, and community fatigue were pushing new development into neighboring counties with more flexible policies and available land. Today, Virginia remains the dominant force in global data center development, but the balance of growth has started to shift. Operators and investors are navigating a more complex landscape defined by regulation, infrastructure limits, and community expectations.

Three Themes That Defined the Market

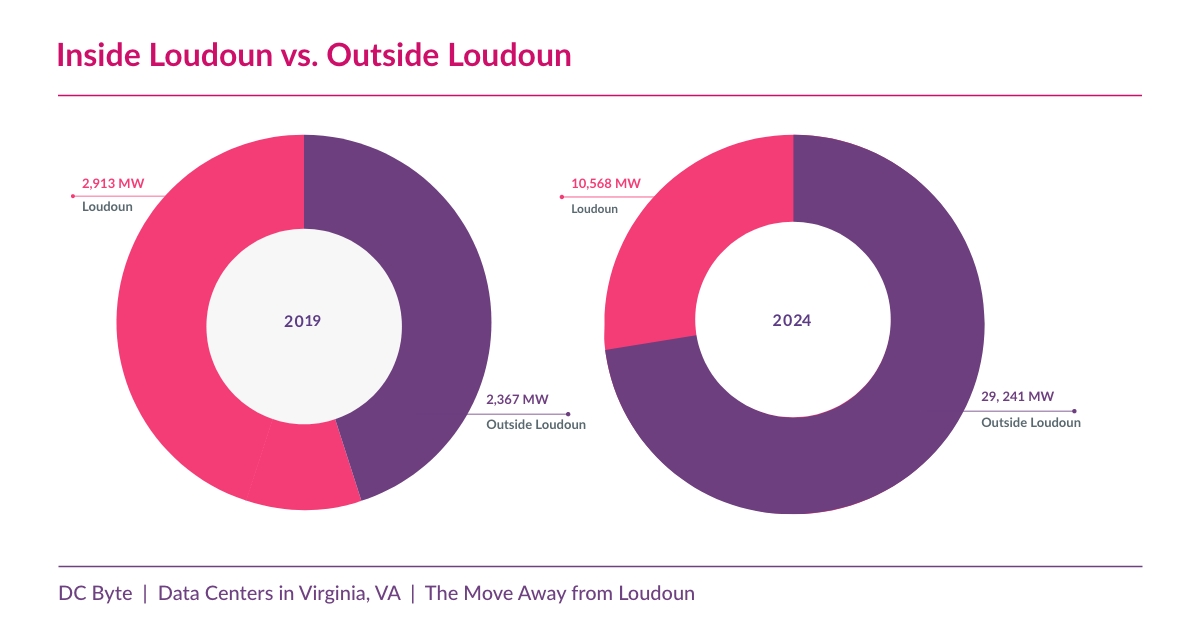

The Gradual Shift Beyond Loudoun

Loudoun County’s decision in 2025 to remove by-right zoning for data centers marked a turning point. New projects now require additional approvals, slowing what was once near-automatic expansion. With Dominion Energy’s power crunch in Northern Virginia (NoVA), the result has been a steady migration of interest toward counties such as Prince William, Henrico, and Culpeper, where planning frameworks and incentives remain more accommodating.

The Rise of Alternative Growth Corridors

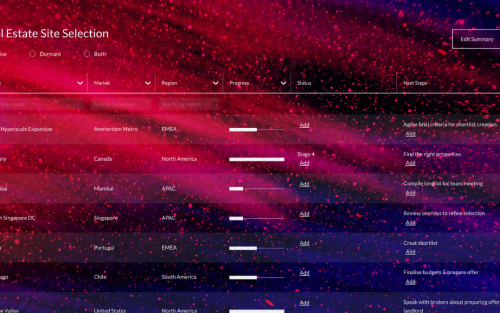

Counties including Culpeper, Prince William, and Spotsylvania are positioning themselves as the next wave of data center expansion. Many have established technology zones, streamlined approvals, and introduced tax benefits to attract investment. Culpeper has been especially active, with its Technology Zone now hosting more than a gigawatt of potential capacity backed by AWS, CloudHQ, and DataBank.

Power Remains the Central Constraint

Energy availability continues to define the pace and location of Virginia’s expansion. Dominion Energy’s grid improvements have been significant, but the scale of demand has outpaced supply. The utility’s contractual commitments nearly doubled from 21GW to 40GW in 2024, reflecting both opportunity and pressure on delivery timelines.

As Senior Analyst Lilli Flynn observes, “Demand continues to rise in Virginia despite long-standing transmission constraints. The key for operators will be to leverage existing infrastructure and focus on areas that remain welcoming to data center development in terms of zoning and permitting.”

Two Developments Reshaping the Market

Increasing Zoning Pushback

In recent months, several major projects have been withdrawn or rejected across Virginia. Tract’s 744-acre proposal in Chesterfield was shelved following infrastructure objections. AWS stepped back from a planned campus in Louisa County after community resistance. In Fredericksburg, Penzance’s 83-acre project was recommended for disapproval, while zoning approval for QTS and Compass Datacenters’ Prince William Digital Gateway was revoked following a lawsuit. Most recently, the 2.2-million-square-foot Gigaland campus in Fauquier County was withdrawn. These reversals highlight a changing political climate where local authorities are prioritising environmental and infrastructure considerations over rapid development approvals.

Longer Build Timelines

Data center delivery schedules across Virginia are extending as developers navigate more complex approval and power allocation processes. Dominion Energy continues to expand its transmission network, but securing substations and connecting new corridors takes time. The outcome is a longer path to operation, with developers increasingly phasing construction around incremental power availability.

One Area to Watch: Culpeper’s Expanding Role

Culpeper County has quickly evolved from a small submarket into one of the state’s most promising new hubs. The county’s Technology Zone, introduced in 2024, offers ready infrastructure, tax incentives, and designated land parcels that align with community planning goals. With Dominion Energy investing in new substations and transmission lines to support this zone, Culpeper is now attracting a mix of hyperscalers and colocation operators seeking viable alternatives to Loudoun.

As Colby Cox, Managing Director for the Americas, notes, “Culpeper’s progress demonstrates that strategic planning and clear local frameworks can unlock long-term potential. It’s an encouraging sign that Virginia’s market can continue expanding while addressing community and power concerns.”

Market Outlook

Virginia’s data center market continues to set the global standard for scale and connectivity. Yet the state’s next chapter will depend on how effectively it manages growth pressures. Balancing power delivery, regulation, and community priorities will determine whether new counties can replicate Loudoun’s success while avoiding its growing pains. The full Virginia Market Spotlight explores these dynamics in greater depth, including data on live, pipeline, and early-stage capacity across all major submarkets.

Download the market spotlight report today.

For organisations seeking local market intelligence with tailored insights, speak to our expert analyst team today.