Deploy Data Center Capital with Confidence. Mitigate Risk with Market Intelligence.

The global data center investment market offers incredible returns, but the risks are equally high. Successful investment requires more than capital. It calls for accurate, forward-looking intelligence that is free from hype. DC Byte provides the definitive source of truth for due diligence and strategic decision-making across every major market.

The Challenges of Data Center Investment

High-Stakes Decisions Under Uncertainty

Deploying multimillion-dollar capital into new projects without reliable data exposes investors to unnecessary risk in volatile markets.

Slow and Inefficient Due Diligence

Collecting and verifying market intelligence manually can take weeks, delaying investment decisions and reducing competitiveness.

Risk of Market Saturation

Without clarity on true demand, investors face the danger of allocating capital into oversupplied or underperforming data center markets.

Lack of Forward-Looking Insight

Most intelligence focuses on the past, leaving investors without visibility into future pipelines, power availability, and the trends that will drive tomorrow’s returns.

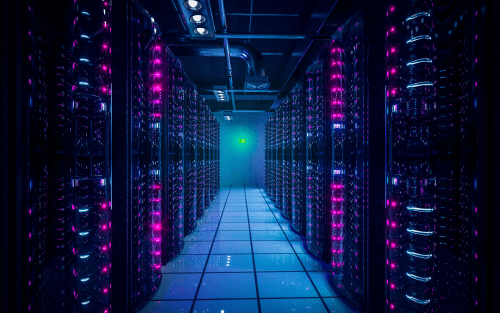

Fueling your data center strategy with trusted global intelligence.

Your Edge in Data Center Investment, Powered by DC Byte

De-Risk Capital Allocation with Trusted Data

Independent, continuously updated intelligence validates where and when to invest. Verified insights on supply, demand and project pipelines reduce uncertainty, strengthen due diligence, and give investors confidence that capital is directed toward the strongest opportunities.

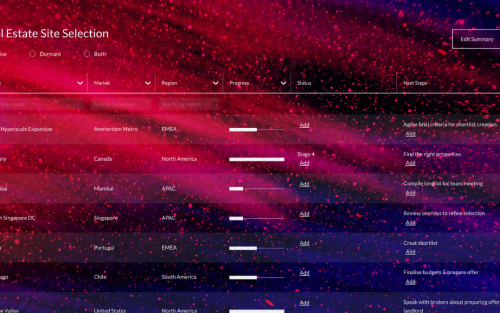

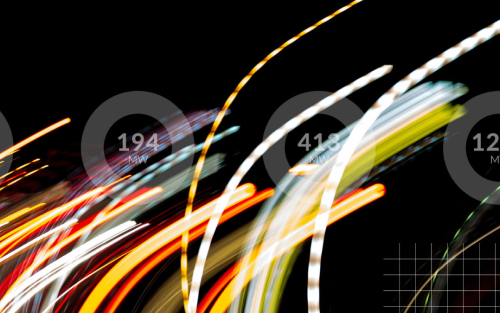

Validate Market Opportunities with Confidence

Benchmark market performance with KPIs such as capacity, absorption and supplier activity. Comparing growth drivers across regions provides investors with the evidence to build credible business cases and ensure portfolio strategies align with long-term demand.

Assess Tenant Pipelines to Forecast Returns

Understanding customer activity is critical to projecting returns. By analysing hyperscale, colocation and enterprise demand, investors gain visibility into leasing patterns and capacity requirements, enabling more accurate revenue forecasts before committing capital.

Back Proven Partners and Developers

Reviewing the track record of operators and suppliers allows investors to identify trusted partners. Visibility into project history and customer relationships reduces execution risk, strengthens portfolio resilience and improves the likelihood of long-term value creation.