Inside a Transformative Year for the Global Data Centre Market

December 16, 2025

From the desk of Bernard Johnson, CEO at DC Byte

Year in Review 2025

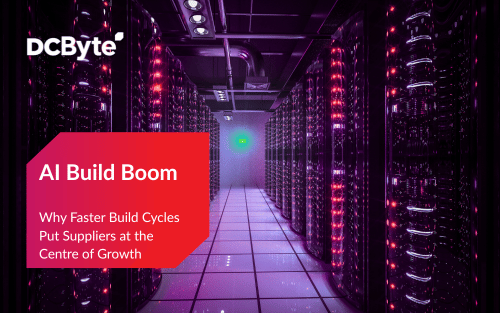

2025 was a defining year for the global data centre industry. Demand continued to rise at a remarkable pace across every region, driven by the combined force of cloud expansion and accelerating AI adoption. Yet the ability to deliver new capacity struggled to keep up. Power constraints, permitting delays and stretched supply chains widened the delivery gap, creating a market where promised capacity increasingly diverged from what could be brought online in time. This imbalance shaped investment decisions, development timelines and competitive strategy throughout the year.

Cloud remained the largest driver of global leased capacity, anchoring multi-megawatt commitments and shaping long-term planning across mature and emerging markets. AI, meanwhile, evolved from a fast-rising workload to a transformative design force. It pushed density expectations higher and introduced new technical requirements for cooling, power distribution and build sequencing. AI did not simply increase demand. It changed the fundamental architecture of modern data centres and accelerated expectations for how quickly new capacity must be delivered.

These shifts placed intense pressure on global infrastructure. Power availability became the key determinant of viable development, outweighing land cost or funding availability. Mature hubs faced extended grid timelines, while markets with scalable renewable generation or stable power planning advanced more quickly. Operators prioritised deliverable power over location history, prompting a redistribution of growth across regions.

Hyperscalers drove this momentum. Their early leasing, land banking and power procurement strategies continued to accelerate, shaping where and how development occurred. Their behaviour influenced regional build cycles, supplier engagement and market competition. As hyperscalers moved, the rest of the ecosystem moved with them.

This created a year defined by both rapid acceleration and strategic recalibration. Growth shifted toward markets where power, policy and planning aligned. Southeast Asia, the Middle East, Southern Europe and parts of the Nordics gained momentum, while traditional hubs faced the reality of limited grid capacity and longer approval pathways. Developers responded by compressing build cycles and engaging suppliers earlier, while suppliers faced rising expectations around certainty, design readiness and delivery windows.

For operators, suppliers and investors, this environment made reliable intelligence essential. Early leasing intensified competition. Long-lead equipment challenges made delays more costly. AI workloads introduced new layers of complexity into design and procurement. The industry found itself navigating conditions where real-time insight into power, timelines, suppliers and development progress became central to decision making.

How This Year Shaped DC Byte

Against this backdrop, the importance of primary research and verified data became even clearer. The market is changing faster than ever, and the cost of relying on incomplete or outdated information has grown significantly. In 2025, our role at DC Byte strengthened around a simple but powerful idea. Organisations across the world need clarity and confidence to plan for the future. They need intelligence they can trust, built from the ground up and validated by experts. This belief guided our work throughout the year and shaped the progress we made as a business.

Global Milestones

Across the business, we reached several important milestones.

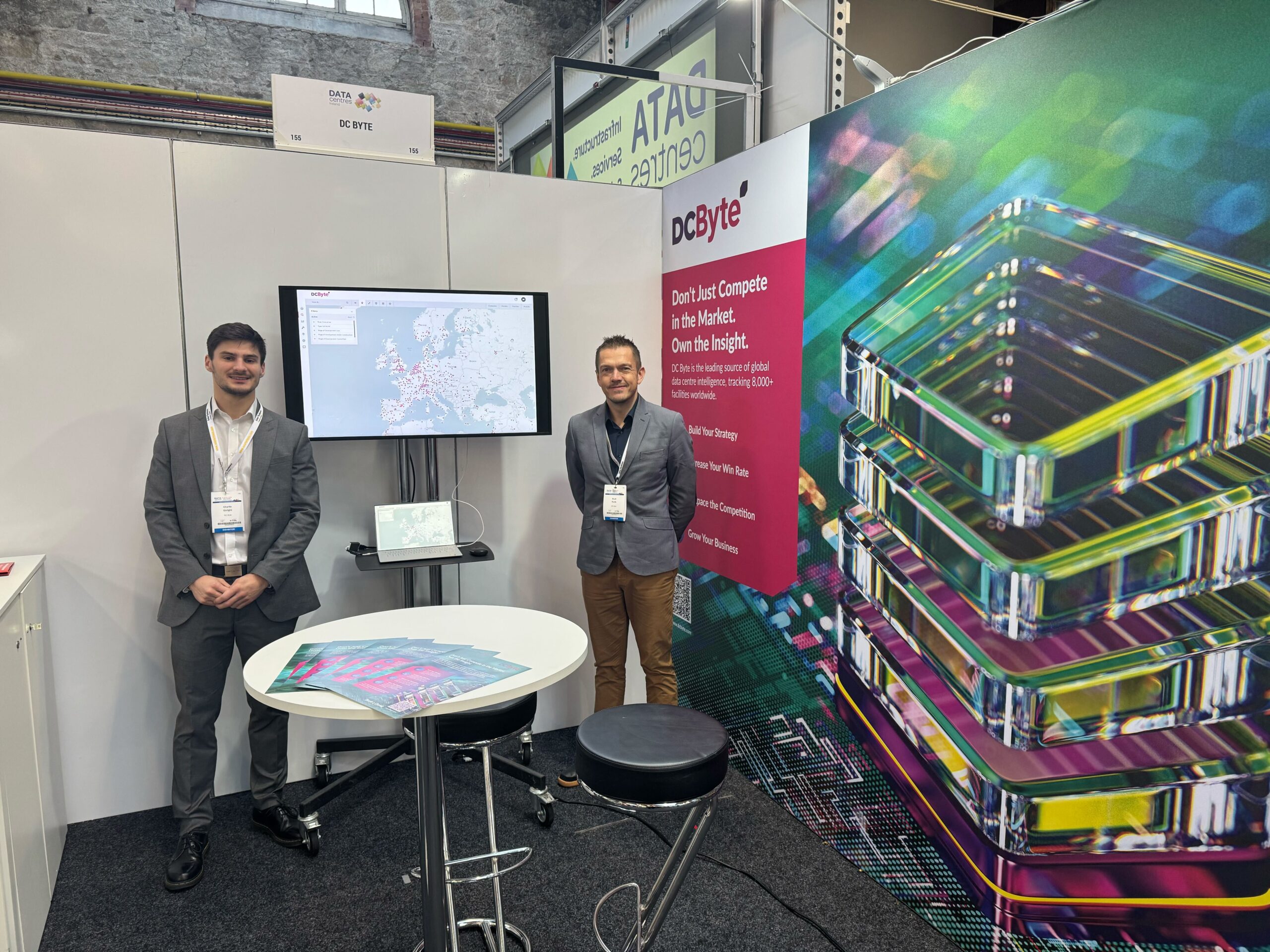

- Our platform surpassed 8,000 tracked developments worldwide, strengthening our visibility across both established hubs and fast-growing markets.

- We published the Global Data Centre Index 2025, which has become a widely used reference for understanding the global delivery gap and the shifts driven by AI.

- With hyperscalers powering most of the industry’s momentum this year, we introduced the Hyperscale Build Race analysis to help customers interpret development velocity and strategic direction.

- DC Byte is powered by its people. This year, our team grew by 20% to reach 53 employees and their expertise ensured that every enhancement we introduced was grounded in primary sourced intelligence and shaped by the needs of our customers.

Regional Milestones

Our offices around the world contributed to this progress in ways that reflected their local strengths and market conditions.

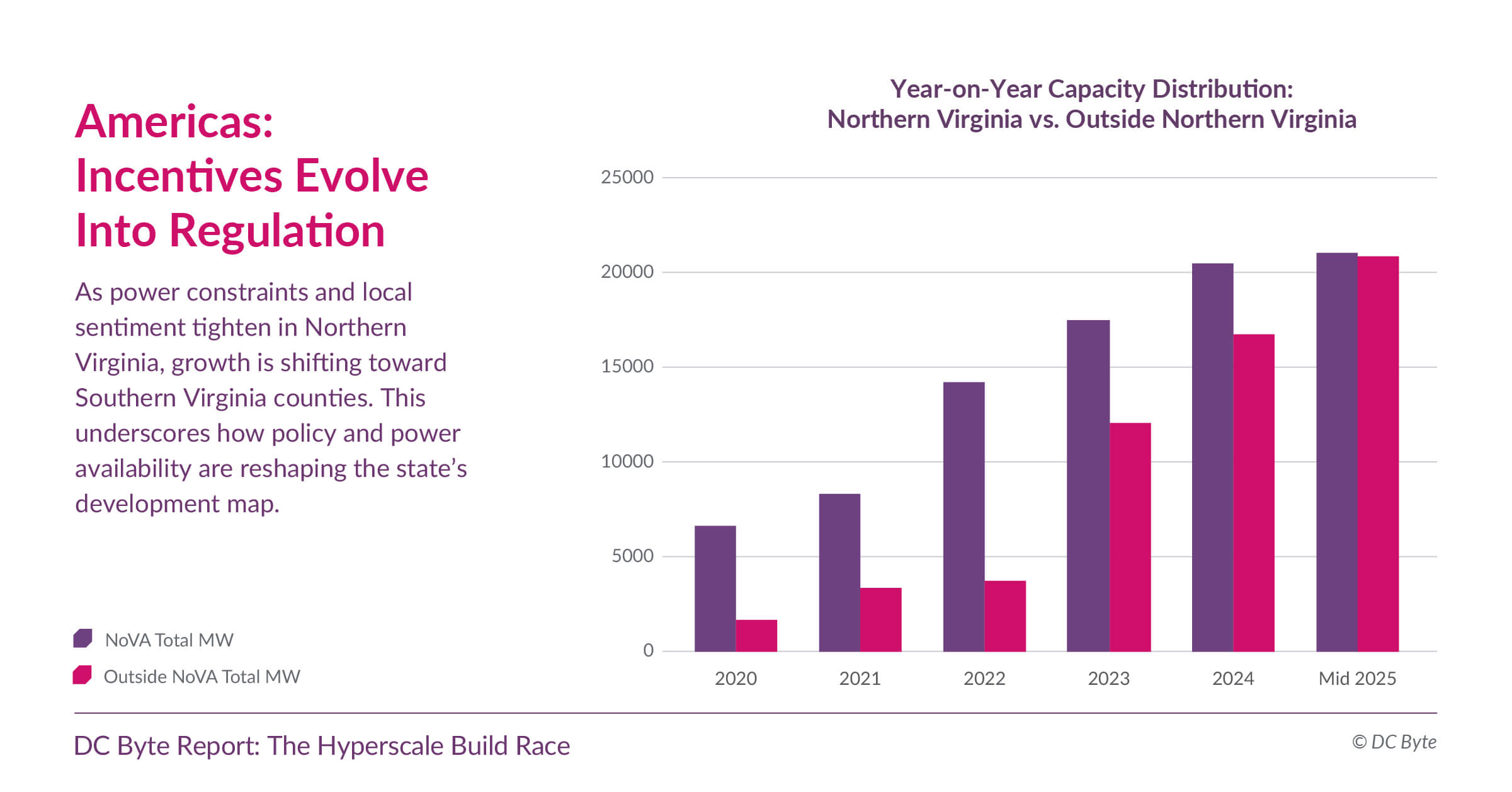

In the Americas, demand from AI workloads and hyperscalers continued to outpace available supply, driving record-low vacancy and sharp increases in rental rates. Power constraints pushed development toward secondary markets, where timelines and availability were more favourable. In response, our team broadened its coverage well beyond the traditional hubs, providing granular regional insight and detailed overviews of new projects, challenges and trends, and helping customers navigate markets where certainty varied widely. Over the past year, the Americas team tracked an additional 92 GW across all four development phases tracked. The team also delivered 12 speaking engagements across the region. Our Americas Managing Director Colby Cox and Research Manager Alexandra Desseyn were recognised with the IM100 Award for Outstanding Contributions to Education in the Digital Infrastructure Industry. The team also grew significantly, expanding from seven to twelve members, with more roles planned for the year ahead.

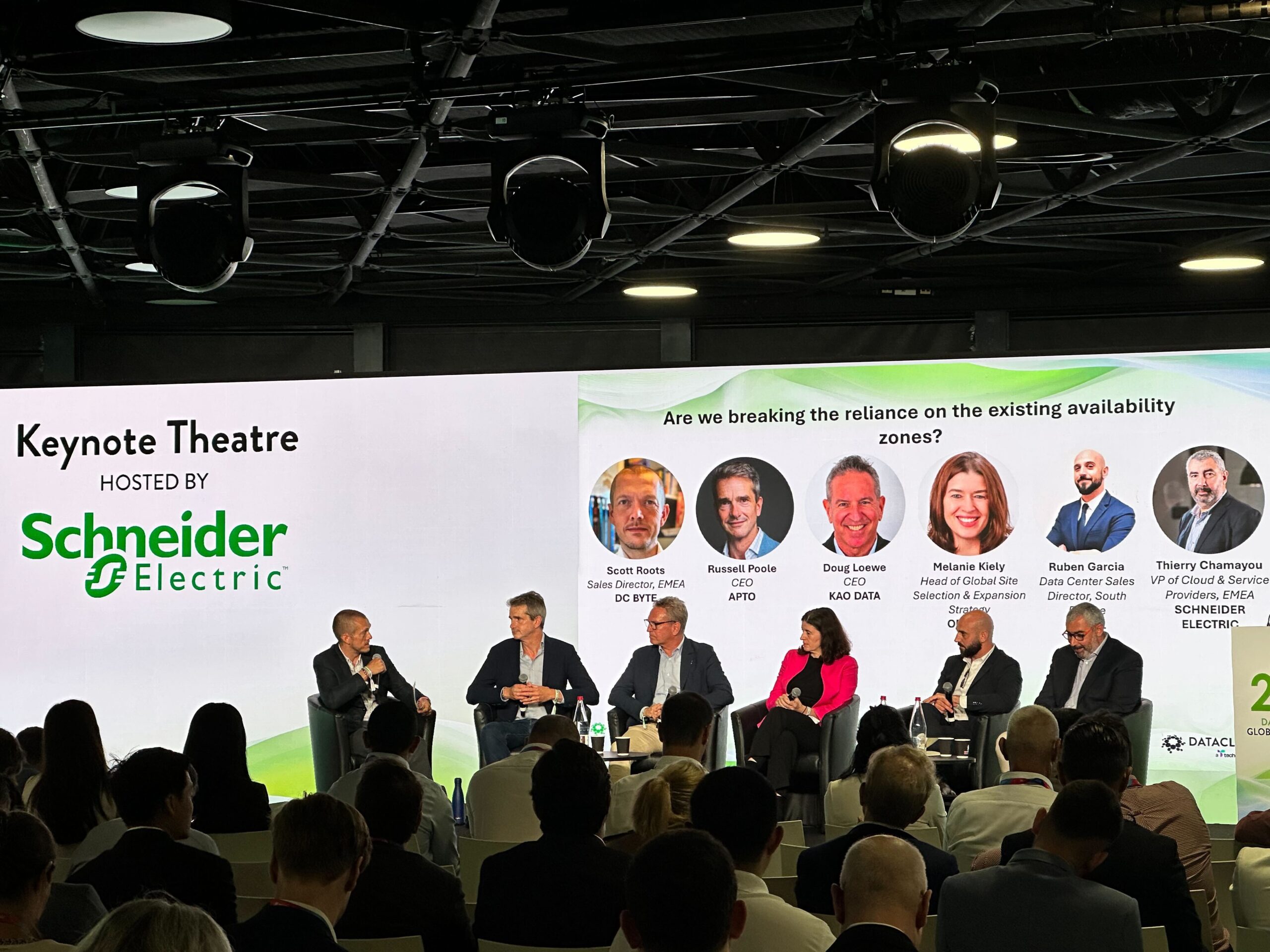

In Europe, the Middle East and Africa, the region experienced a pivotal shift marked by the rise of neocloud operators and a wave of multi-gigawatt hyperscale announcements. As FLAP-D markets continue to tighten due to increasing pressure on both land availability and power, secondary markets have stepped confidently into the spotlight, accelerating growth and reshaping regional deployment strategies. Our EMEA team remained highly visible across the industry, contributing to more than 15 speaking engagements throughout Europe and Africa and supporting conversations at the highest levels of the sector. We also expanded our tracking efforts to 58 GW capacity, up from 40 GW at the end of 2024, reflecting both the rapid pace of growth and the accelerating scale of demand across the region.

In Asia Pacific, AI-driven workloads strengthened activity across Asia Pacific, especially in countries where abundant land, accessible power and lower development costs enabled projects to scale quickly. Our teams assisted clients with presentations to boards of directors and prospective investors in both Singapore and Tokyo, reflecting the strategic importance of these markets. They also completed 27 market inspection trips this year and held our first APAC Data Centre Landscape Briefing in Hong Kong. The APAC research team was recognised with the 2025 Data Centre Market Intelligence Team Award, underlining the consistency and depth of their work across the region.

Together, these achievements strengthened the accuracy and completeness of our global intelligence and positioned us to support our customers with greater clarity.

How We Evolved Our Platform to Support Our Customers

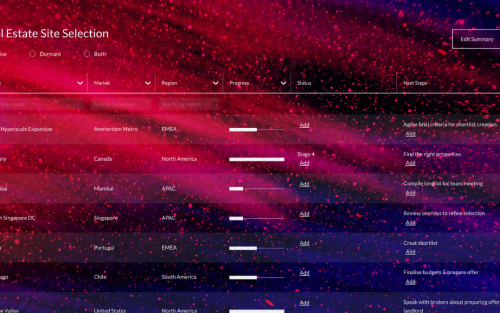

The pace and complexity of development this year called for tools that help organisations plan with greater confidence.

Much of this was driven by two forces. The first was the growing influence of hyperscalers, whose build strategies and power planning now define market activity in many regions. The second was the expanding role of suppliers in AI ready projects, where equipment lead times and vendor involvement directly influence delivery outcomes.

To support our customers, we introduced tools that address these shifts directly. Supplier Analytics gives users a clearer view of the companies associated with individual projects. This helps organisations understand vendor ecosystems, identify emerging partnerships and anticipate risk as they plan multi-phase or high-density builds.

Hyperscaler Analytics was designed to help customers interpret the behaviour and strategy behind hyperscale development. It provides insight into build velocity, market selection and long-term power planning, offering important context for teams whose work intersects with hyperscaler demand.

These additions were created with a simple aim. As the industry evolves, our customers should always have the clearest possible understanding of the forces shaping it.

Looking Ahead to 2026

The trends we observed throughout 2025 suggest that power generation and availability will remain central to global growth. Markets with strong renewable potential or planned grid expansion are likely to move ahead faster. Hyperscalers will continue to secure land and power earlier in the planning cycle. Delivery confidence and transparency will remain essential for organisations evaluating long term investment.

AI will continue to influence density, procurement and design. These changes will shape how campuses are built, how suppliers operate and how operators plan their next phases of expansion. We will continue investing in our platform, our research and our people to support our customers as they navigate these shifts.

A Final Word of Gratitude

I want to thank our teams across the Americas, Bulgaria, United Kingdom, Singapore, and the wider regions we cover. Your commitment to rigorous research and thoughtful product development is what makes DC Byte the global reference point for market intelligence. I also want to thank our clients and partners for placing their trust in us during a year of significant change.

The year ahead will bring new challenges and new opportunities. We look forward to navigating them with you and supporting the continued growth of our industry. Here is to a productive and exciting 2026.