January 20, 2026

Asia Pacific is entering a new phase of data centre development. Demand continues to rise, but the rules governing where capacity can be delivered, how quickly it can be built, and what infrastructure is required are changing fast.

Across the region, power availability, policy frameworks, and AI-driven workloads are now shaping outcomes more than headline demand alone. Mature hubs are tightening controls. Emerging markets are scaling faster, often leapfrogging traditional development models. Pipelines are growing, but delivery risk is becoming more visible.

This insight piece brings together DC Byte’s latest APAC research to highlight five structural shifts redefining the region’s data centre landscape and what they signal for operators, investors, and suppliers planning their next moves.

1. Growth Is Shifting From Scale to Execution

APAC has been one of the fastest-growing regions globally for data centre capacity. However, growth is no longer defined by how much demand exists. It is defined by how effectively capacity can be delivered.

Across Southeast Asia, pipelines are heavily weighted toward early-stage projects. This reflects strong interest, but it also introduces execution risk around power allocation, permitting, and timelines. Markets that can move projects from pipeline to production are pulling ahead.

This shift mirrors patterns already seen in more mature regions and marks a transition from expansion to delivery discipline.

2. Mature Hubs Are Becoming Control Towers, Not Growth Engines

Markets such as Singapore remain critical to regional connectivity, financial services, and high-value workloads. However, policy frameworks, sustainability requirements, and power constraints are limiting large-scale expansion.

Rather than absorbing bulk capacity, these hubs are increasingly acting as control towers. They anchor regional ecosystems while pushing scale-driven development into neighbouring markets. This has accelerated multi-market deployment strategies across Southeast Asia.

The result is a more distributed regional model, with clearer separation between control, compute, and scale.

“What we are seeing across Asia Pacific is not a slowdown in demand, but a recalibration of how growth happens. Capacity is still coming, but it is increasingly shaped by power access, policy alignment, and execution certainty. Understanding those dynamics early is becoming a competitive advantage for every stakeholder in the market.”

– James Murphy, Managing Director, APAC, DC Byte

3. Southeast Asia Is Driving the Region’s Next Growth Cycle

Southeast Asia is now outpacing Northeast Asia and ANZ in both capacity growth and pipeline expansion. Over the past three years, the subregion has recorded significantly higher compound growth rates, supported by land availability, improving infrastructure, and more permissive policy environments.

Markets such as Malaysia, Indonesia, and Thailand are no longer emerging alternatives. They are becoming core components of regional deployment strategies, particularly for large-scale and AI-ready capacity.

This shift is redefining how Asia Pacific grows as a whole.

4. New Markets Are Skipping the Retail Phase

Several APAC markets are moving directly into campus-scale and hyperscale development without a long intermediary retail phase.

Thailand is a clear example. Development has rapidly transitioned from smaller facilities to multi-building campuses, particularly in zones such as the Eastern Economic Corridor. Average project sizes are increasing, and infrastructure is being planned with future density and expansion in mind.

This reflects a more mature understanding of long-term demand and highlights where early planning around power and land is becoming decisive.

5. AI Is Forcing Earlier Infrastructure Decisions

AI workloads are accelerating the need for power-dense, high-specification infrastructure across Asia Pacific. In several markets, AI represents a growing share of total demand, alongside sustained cloud expansion.

This is pulling power planning, site selection, and leasing decisions earlier in the development cycle. Markets that can support AI-ready infrastructure from day one are gaining momentum, while others risk falling behind despite strong demand signals.

AI is no longer a future overlay. It is reshaping capacity planning today.

Explore the Data Behind These Shifts

These structural changes are already visible across DC Byte’s Asia Pacific coverage. Each reflects real movement in capacity, pipelines, and delivery conditions across the region.

To go deeper, explore our latest APAC insights:

Bangkok Market Spotlight

A detailed look at Southeast Asia’s next breakout data centre hub, including capacity scale, project pipelines, and the rise of the Eastern Economic Corridor.

Singapore Data Centre Market Snapshot

What DC-CFA2 and sustainability requirements mean for future growth, deployment strategies, and regional spillover.

Inside Asia Pacific’s Data Centre Boom

A comparative view of Southeast Asia, Northeast Asia, and ANZ, highlighting where growth is accelerating and why.

The Hyperscale Build Race – APAC and Global Insights

How power, policy, and delivery speed are reshaping hyperscale development across the region.

Turn Insight Into Action

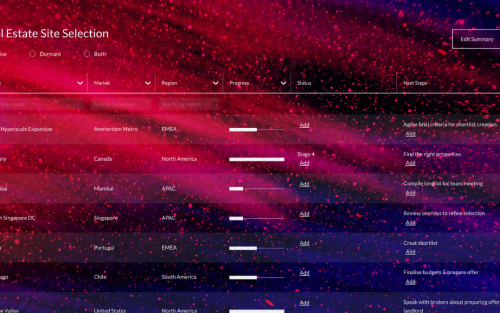

DC Byte tracks data centre markets across Asia Pacific in real time, with facility-level data, project pipelines, and forward-looking analysis that helps teams act earlier and with greater confidence.

If you are planning expansion, assessing risk, or tracking where capacity is most likely to come online next, our platform gives you the visibility to move decisively.

Access our APAC insights and explore the data shaping the region’s next phase of growth.