January 12, 2026

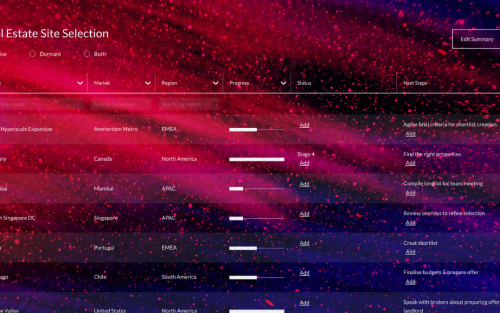

The hyperscale data center market is entering a new phase across the Americas. Speed, certainty and long-term planning now matter more than raw build volume. Leasing has emerged as one of the clearest indicators of how data center hyperscalers secure future capacity. What was once a transactional step has become a strategic tool that shapes where operators deploy, how they mitigate constraints and which hyperscale data center locations move to the forefront of growth.

Nowhere is this shift more visible than in the United States, where tightening conditions in established hubs and momentum in emerging corridors reveal how early commitments are reshaping the next chapter of digital infrastructure.

A Brief Global Lens: Why the Americas Stand Out

Compared to other regions, the Americas illustrate leasing’s evolution most clearly. In EMEA, pre-leasing is standard in major hubs where power availability and planning timelines influence delivery and contributed to a 30% increase in London hyperscale lease rates within one year. In Asia-Pacific, the balance between self-builds and leasing varies by market maturity and regulatory structure. These global patterns reflect how leasing has become a core planning tool across hyperscale data center markets and highlight why the Americas offer a clear view of how these dynamics are unfolding.

Virginia: The Center of Early Leasing

Northern Virginia remains the largest hyperscale data center market in the world, yet it now operates under increasing pressure. The market operates in a far more constrained development environment, where limited grid capacity, land scarcity and heightened local scrutiny are slowing approvals and extending delivery timelines.

Against this backdrop, leasing has become an early planning mechanism. Entire buildings or multi-building campuses are often leased to a single hyperscaler, with lease sizes ranging from tens to hundreds of megawatts. Smaller enterprise deals under 10 MW have become rare as developers prioritize large-scale requirements. Pre-leasing has strengthened as data center hyperscalers move to secure capacity and delivery timelines.

As noted by Alexandra Desseyn, Research Manager for the Americas at DC Byte, “Leasing has become one of the strongest forward indicators of hyperscale strategy in the Americas. When operators begin committing to entire campuses years before completion, it tells us exactly where they expect demand to materialize and which markets have the conditions to deliver on schedule.”

The Southeast: Leasing as a Driver of Development Speed

The Southeast has emerged as one of the fastest-growing subregions for new hyperscale data center commitments in the Americas. A combination of coordinated utility planning, supportive state-level incentives and scalable greenfield sites is allowing projects to move from commitment to construction at pace within this subregion. In these markets, leasing plays a central role in accelerating build timelines.

Developers across the Southeast are signing anchor tenants 24 to 36 months ahead of completion and much of the under-construction capacity is already pre-leased. Several major data center hyperscalers have committed to entire campuses or multi-building sites and build-to-suit agreements are common. These patterns align with DC Byte’s findings that infrastructure readiness and policy stability help attract follow-on growth and support expanding regional ecosystems.

As Siddharth Muzumdar, SVP of Research at DC Byte, observes, “What we are seeing now is a fundamental shift in how hyperscalers sequence their growth. Leasing is no longer a bridge to self-build. It is a planning strategy that aligns power, land and delivery risk long before a shovel hits the ground.”

Southern Virginia and Emerging States

Within Virginia, data center hyperscalers are expanding south from established hubs into counties such as Louisa and Spotsylvania, where utilities can offer faster access to capacity. This shift mirrors broader regional decentralization trends described in one of our latest reports. Across the Southeast and adjoining states, governments and utilities are introducing incentive packages, adjusting electricity rate structures and strengthening foundational infrastructure to position themselves for future hyperscale data center development.

These movements demonstrate how early leasing helps shape emerging ecosystems. Each new entrant strengthens collaboration among utilities, construction partners and workforce providers, contributing to long-term market maturity and influencing which hyperscale data center locations gain momentum.

Conclusion: Leasing as a Long-Term Planning Tool

Across the Americas, leasing has become a forward planning instrument that aligns operators, utilities and developers early in the build cycle. In mature hubs, it secures scarce capacity. In emerging corridors, it accelerates project delivery. For operators and investors, early leasing supports long-term planning and reduces uncertainty. For policymakers, leasing patterns indicate where regulatory readiness, incentives and energy planning are effectively supporting hyperscale expansion.

Leasing is a defining feature of the hyperscale build race in the Americas and a core mechanism shaping how and where future hyperscale data center capacity will be delivered.

The next phase of global data centre growth will not be defined by headline pipeline numbers, but by execution. In an increasingly constrained environment, certainty is becoming one of the industry’s most valuable currencies.

Keen to learn more about the Hyperscale Build Race? Get a copy of the report here.