December 10, 2025

The hyperscale build race across the Americas is entering a phase defined by power availability, policy direction and the need for delivery certainty. The region now operates at two speeds. Established hubs face tightening constraints, while emerging corridors accelerate through incentives, utility partnerships and more scalable development conditions. These contrasts highlight how power and policy have become central to hyperscale data center strategy and long-term planning across the Americas.

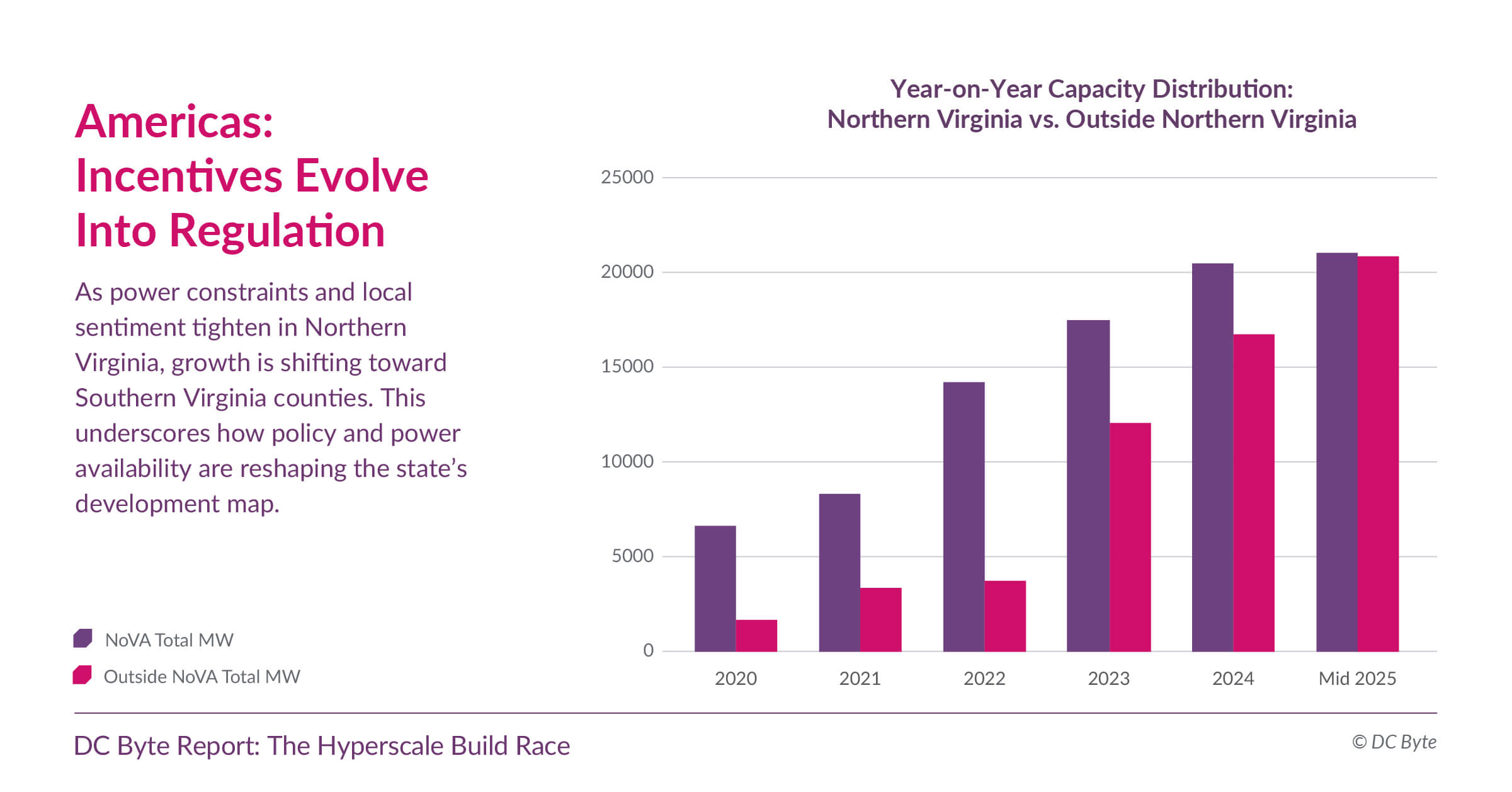

Virginia: From Growth Engine to Constraint

Northern Virginia remains the world’s largest hyperscale data center market, yet it now faces growing structural challenges. Power and land availability are tightening and project approvals have become more complex due to grid congestion and community resistance. Major power providers project multi-year timelines for large-scale grid connections and vacancy has been below 1% since 2022, with most new capacity committed before construction begins.

Policy frameworks in the state are also shifting. Longstanding tax exemptions continue to attract investment, while proposed energy and operational requirements introduce a higher level of compliance. Several counties have strengthened zoning oversight and placed more stringent conditions on large developments. These shifts signal a move from rapid, broad-based expansion to a more regulated environment that prioritizes infrastructure management.

As these pressures build, hyperscale activity is beginning to redistribute within the state. Growth is moving toward areas where utilities can offer faster access to capacity and where development conditions are more flexible. This reflects a broader trend identified in the report, where activity shifts to hyperscale data center locations that can guarantee timely power access and permitting clarity.

According to Alexandra Desseyn, Research Manager for the Americas at DC Byte,

“Across the Americas, tightening power availability is redefining the data center leasing playbook. Pre-leasing has become both a defensive move against grid uncertainty and a strategic lever for hyperscalers to lock in future capacity before the market tightens.”

The Southeast: Incentives and Scalability Drive New Momentum

While Virginia navigates constraint, the Southeast has emerged one of the fastest-growing subregion for new hyperscale commitments in the Americas. States in this corridor are combining low-cost land, utility collaboration and incentive-led regulation to create competitive development environments that attract sustained activity. Special electricity rates and evolving utility structures further strengthen the region’s appeal.

The report highlights how early investment in the Southeast has laid foundations for continued momentum. As operators expand with larger campuses and long-term development plans, incentives and infrastructure readiness have reinforced the region’s rising importance in national deployment strategies. Several emerging states are also strengthening their policy and infrastructure frameworks to position themselves for upcoming demand.

This matches the wider finding that policy stability, grid accessibility and development-friendly regulation create compounding effects that draw follow-on investment and accelerate regional scaling, especially in new hyperscale data center locations.

Policy as a Shaping Force Across the Americas

Policy direction across the Americas is diverging in line with market maturity. In established hubs, tightening environmental oversight, zoning requirements and grid pressure restrict development pace. In emerging corridors, incentive-led frameworks and aligned utilities continue to produce favorable conditions for hyperscale growth. The report describes this as a region operating at two speeds, shaped by different levels of regulatory readiness and power availability.

Colby Cox, Managing Director for the Americas at DC Byte, notes that

“Power availability has become the single most decisive factor in determining project viability.”

This finding underscores why hyperscalers are planning earlier in the development cycle and why policy frameworks that shape permitting outcomes, utility coordination and long-term power strategies are now central to competitive positioning.

A Brief Global Reference Point

The Americas reflect a global pattern, although each region faces its own regulatory dynamics. In Asia-Pacific, policy ranges from tight controls in mature hubs to streamlined, incentive-based environments in emerging markets. In EMEA, strict planning and sustainability requirements in core hubs encourage hyperscalers to secure capacity years in advance, driving up lease rates in markets with constrained supply. These contrasts highlight how the Americas combine constrained legacy hubs with momentum in new corridors supported by incentives, infrastructure availability and diversified hyperscale data center market conditions.

Certainty Defines the Next Phase

The hyperscale build race in the Americas reflects a central theme of the report. Success now depends on how predictably, sustainably and efficiently capacity can be delivered in markets shaped by power and policy. For operators, securing power and land well ahead of demand is essential. For investors, understanding regulatory readiness and infrastructure timelines defines long-term opportunity. For policymakers, the balance between enabling growth and managing grid and permitting pressure will determine competitiveness.

Power and policy are now at the center of decision-making for data center hyperscalers across the Americas and will shape the region’s role in the global hyperscale data center landscape.

Access the Full Report

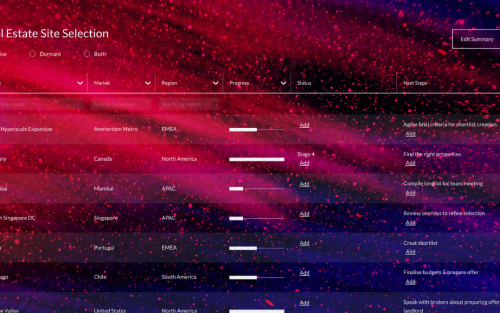

These global dynamics are tracked in detail through DC Byte’s Hyperscaler Analytics, which brings together verified insight on hyperscaler activity, presence and expansion patterns across markets. Book a demo to get a first-hand experience of the analytics at work.

Our latest report – The Hyperscaler Build Race – provides deeper regional analysis across the Americas, APAC and EMEA, helping decision makers understand how power, policy and delivery certainty are reshaping the future of hyperscale development. Read the full report today.