Until 2015 India was very much considered an under-developed data centre market. However, in the last few years it has become one of the major players in the APAC region. This growth trajectory is being driven by a number of factors including the government’s commitment to transform India into a “digitally empowered” society; the significant rise in cloud adoption; as well as unprecedented data consumption by in excess of half a billion domestic digital users.

The introduction of a new policy by the Indian Ministry of Electronics & IT which simplifies planning consents for data centre development, combined with the growth in national connectivity and corresponding data usage, means that data centre demand will continue to be strong for the foreseeable. This can be demonstrated in the number of joint ventures between international and domestic players that have been announced in the last twelve to eighteen months.

2021 saw a significant increase in the acquisition of land and plans for data centre development. We believe that 2022 will be the “year of delivery” with many of last year’s projects coming to fruition and construction commencing.

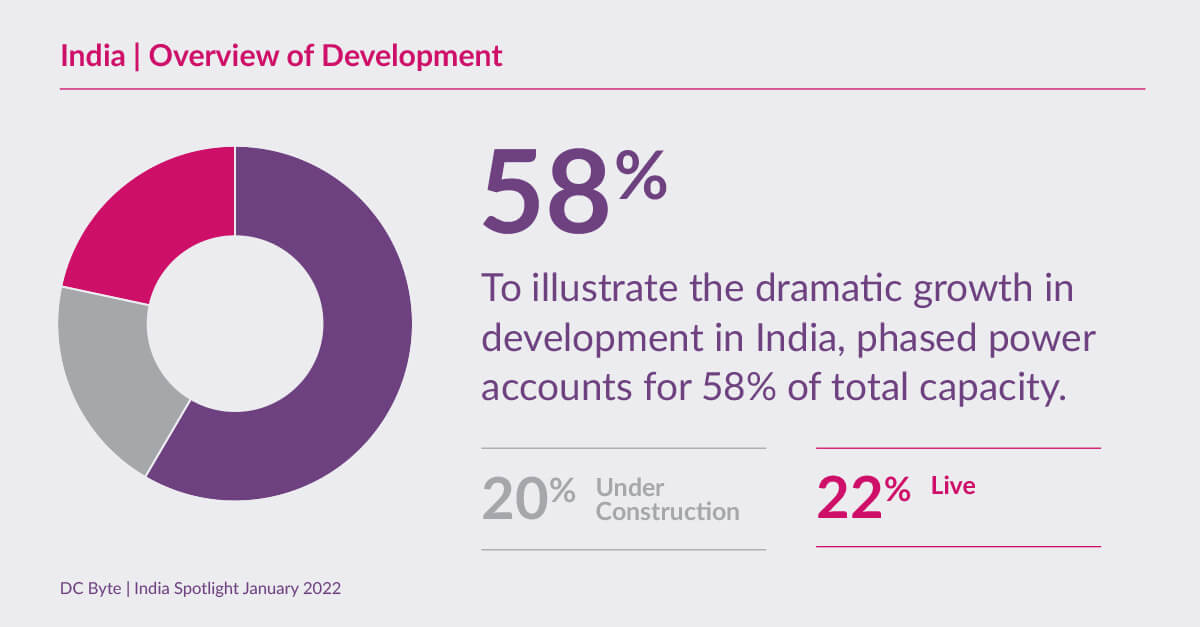

The recent dramatic growth is perhaps best illustrated by looking at the overview of current development in India, where phased (planned) power accounts for 58% of total capacity, compared to live at 22% and under construction at 20%.

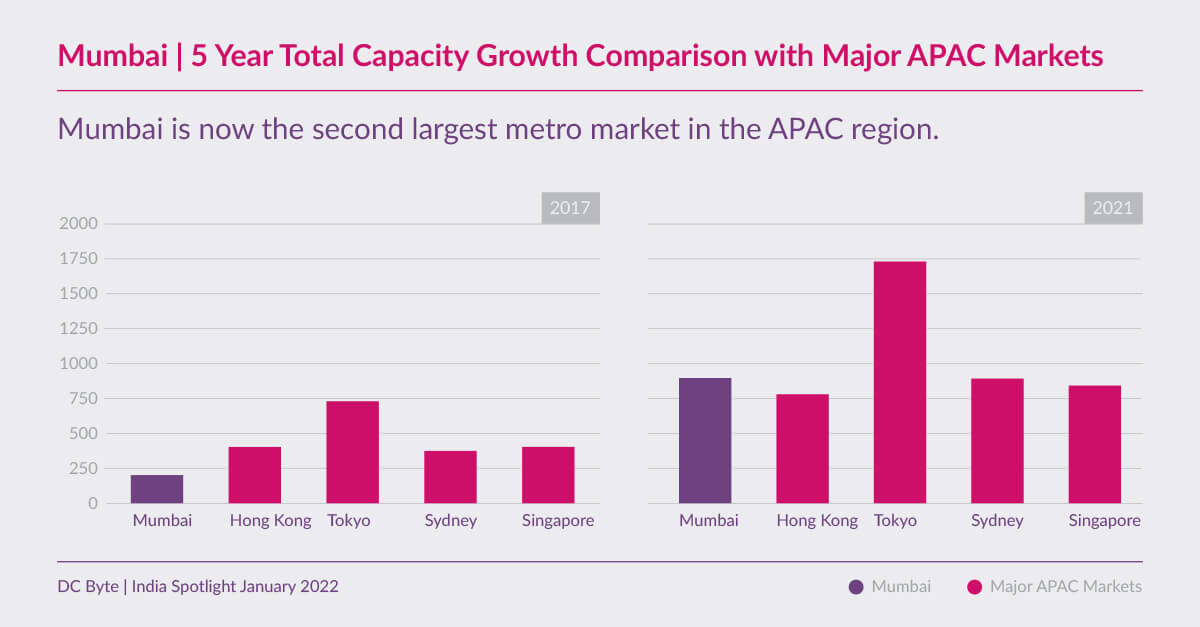

It’s interesting to see how India’s primary metro market, Mumbai, compares to other markets both in EMEA and APAC currently and over the last five years in order to gain some insight into the scale of growth. Looking at the increase in total capacity of Mumbai, it has grown from 202MW in 2017 to 890MW in 2021 – just under 340%.

Compare that to the largest APAC market, Tokyo, which has seen an increase of 137% from 2017 to 2021. Mumbai’s current total capacity positions it as the second largest metro market in the APAC region. This is reflected in the overall trend in APAC; historically international players were more attracted to Japan, Hong Kong and Singapore, however latterly this interest has increasingly shifted towards India and other less established south east Asian markets which have demonstrated strong growth.

London, the largest EMEA market, has seen an increase of 156% over the same five year period. Mumbai’s growth, now means it has exceeded Paris and is closer in size to Amsterdam and Frankfurt.

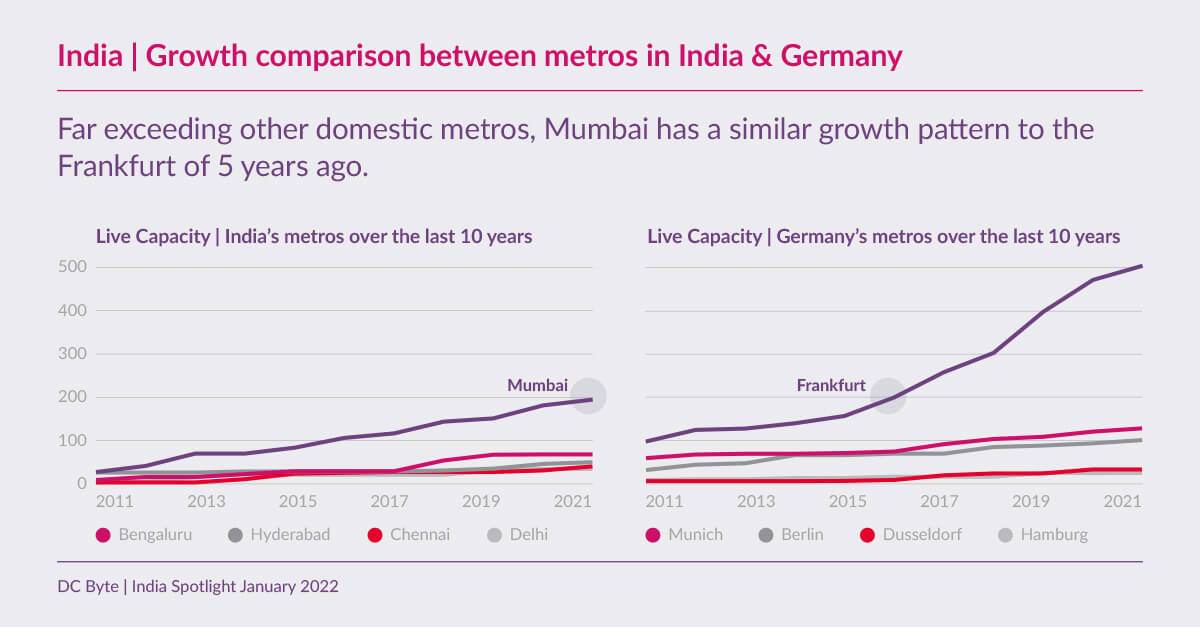

In fact, Frankfurt and Mumbai have seen similar levels of growth in live IT capacity over the last ten years, with both markets far outpacing the rest of the metros in their respective countries. Mumbai’s current live capacity is 193MW which was the same as Frankfurt’s live capacity over 5 years ago. In 2022, we expect Mumbai to see the highest supply increase as more facilities go live.