The Nordics, which comprise of Denmark, Sweden, Finland, Norway and Iceland, have historically been considered as some of the smaller data centre markets. However, recently we have seen significant growth in this region with average aggregate annual growth equivalent to approximately 232MW since 2017.

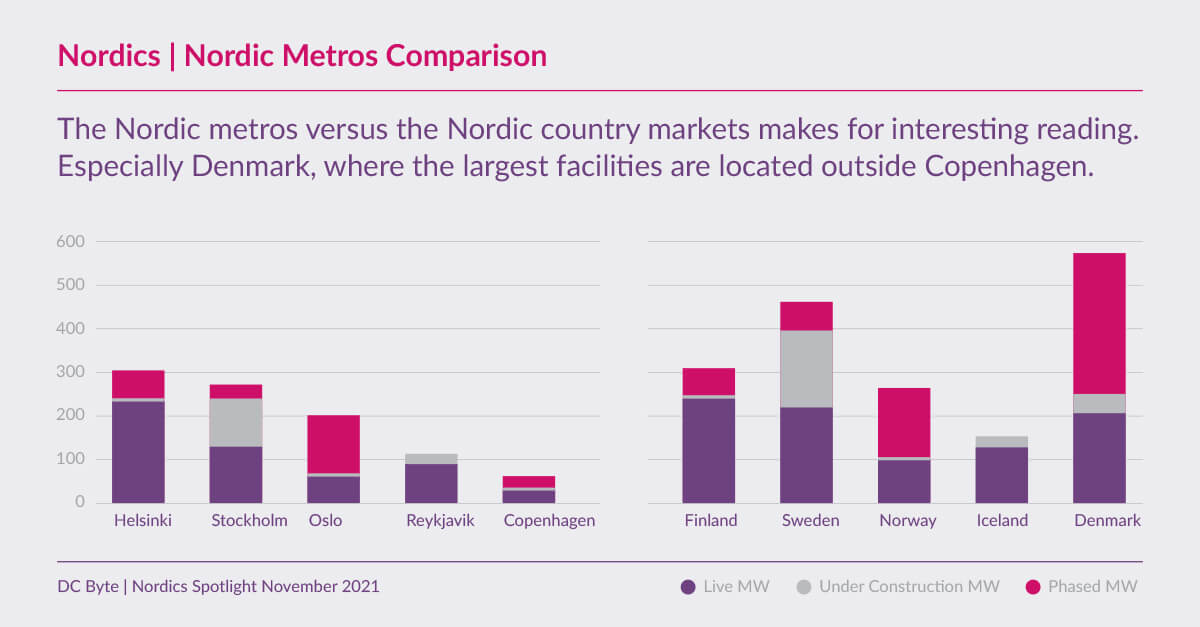

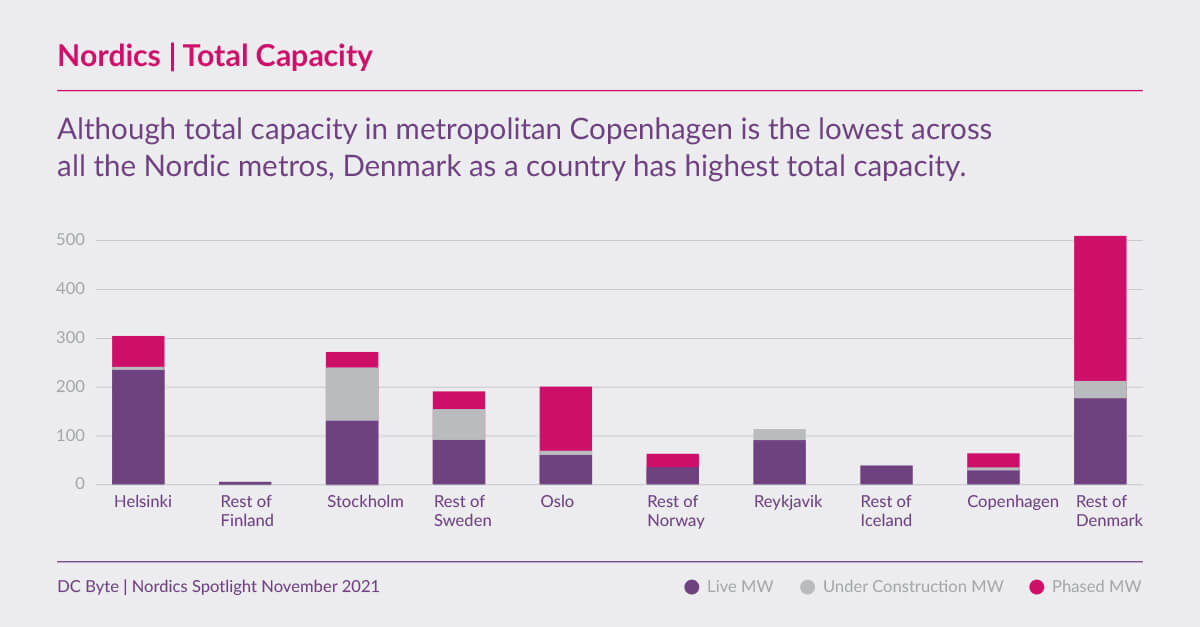

The Nordics stand out when comparing the scale of their metro markets to the overall size of their country markets. While Helsinki has the greatest IT capacity, Finland as a country has the third highest capacity; with Denmark and Sweden topping the table.

Country Markets

Finland

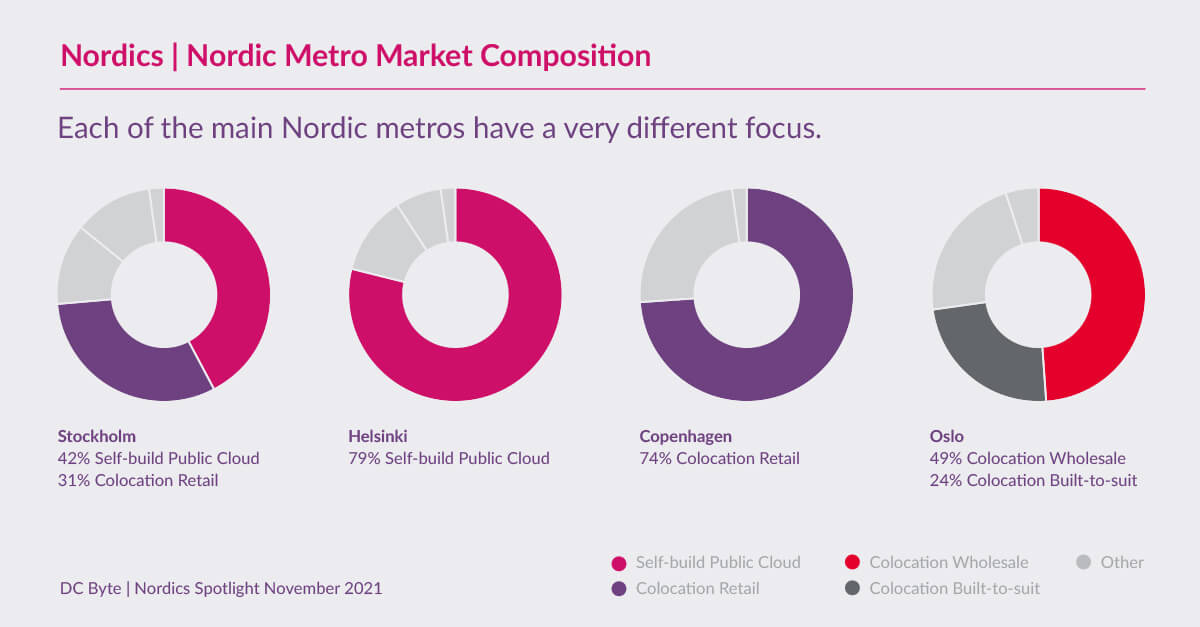

Helsinki’s total data centre capacity puts the city into a market leader position in comparison to some of the main European metros. However, the vast majority of that capacity comes from a single hyperscaler, while its colocation market is much smaller; making its composition similar to Dublin. On average, the Finnish country market has seen an additional 3MW of live supply annually since the early 2000’s.

Iceland

Iceland, is the only one of the five Nordic markets to not yet have any public cloud deployments, despite having a relatively high level of IT capacity. The market itself in terms of size is positioned between Warsaw and Istanbul both of which are attracting quite a lot of attention at the moment. The national market had over 120MW of supply added in the 5-year period from 2015 to 2020.

Sweden

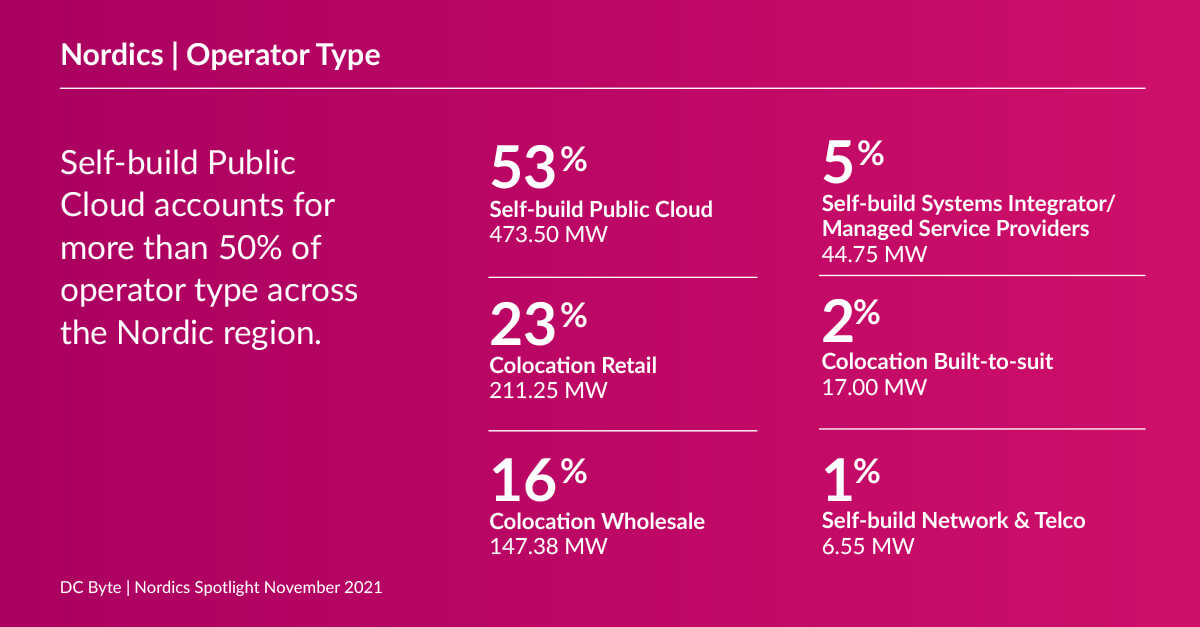

The Stockholm market has grown significantly in the past few years. From 2017 to 2020 there was 220MW of total supply added – split fairly evenly between self-built public cloud and retail colocation developments. Like Finland, the data centre industry in Stockholm has grown at an average rate of 3MW a year going live, excluding hyperscale deployments.

Denmark

Most of the large facilities in Denmark are located within peninsula of Jutland. Although the market share for self-built public cloud deployments is very high, the market live capacity without hyperscale facilities is equivalent to Luxembourg. Half of the total self-built public cloud deployments across the Nordics are located in Denmark.

Norway

Of all Nordic markets, Norway stands out with its phased capacity which is 1.6 times the size of its current live capacity. The Norwegian market is dominated by wholesale data centres followed by retail colocation accounting for around a third of the market share and a further 17% by colocation built-to-suit facilities. In 2021 the Norwegian market has grown by an estimated 114MW of IT power and today is triple the size that it was in Q4 2017.